Hey there,

I wanted to share a few articles and blog posts that capture the state of venture pretty well in my opinion (in no particular order). They do a good job setting the pace for investors and entrepreneurs in 2020.

I have a longer-form piece analyzing some venture trends in Boston on the way. If you want a sneak peek, shoot me a message.

Capital is not a Moat, and What Happened in the 2010s

Fred Wilson wrote a fantastic article summarizing the state of tech this decade. It covers the emergence of web monopolies, “Capital as a Moat,” AI/ML traction, and more. While you’re there, check out his article on tech predictions for the 2020s. (Source)

“Accumulating a data asset around your product and service and using sophisticated machine learning models to personalize and improve your product is not a nice to have. It is a must-have. This ultimately benefits the three large cloud providers (Amazon, Google, Microsoft) who are providing much of the infrastructure to the tech industry to do this work at scale, which is how you must do it if you want to be competitive.”

AngelList’s Narrative Violation™️

AngelList claims that if you miss the best-performing seed investment, you will eventually be outperformed by someone who blindly invests in every credible deal. AngelList’s Head of Data Science published the piece “Startup Growth and Venture Returns: What We Found When We Analyzed Thousands of VC Deals” last month and shook up the early-stage investment community. Their research indicated that broadly indexing into every “credible” deal may yield superior returns, similar to mutual funds in the public markets. Besides the fact that being “credible” is probably a lot different for me than it is for Paul Graham, I was very surprised to read about this. (Source)

“Simulations on 10-year investing windows for seed-stage deals suggest fewer than 10% of investors will beat the index, even if those investors have skill in picking deals. Like Vanguard has taught us in the public markets, individual investors could benefit from viewing the index as the default and then overlaying individual deals that they like.”

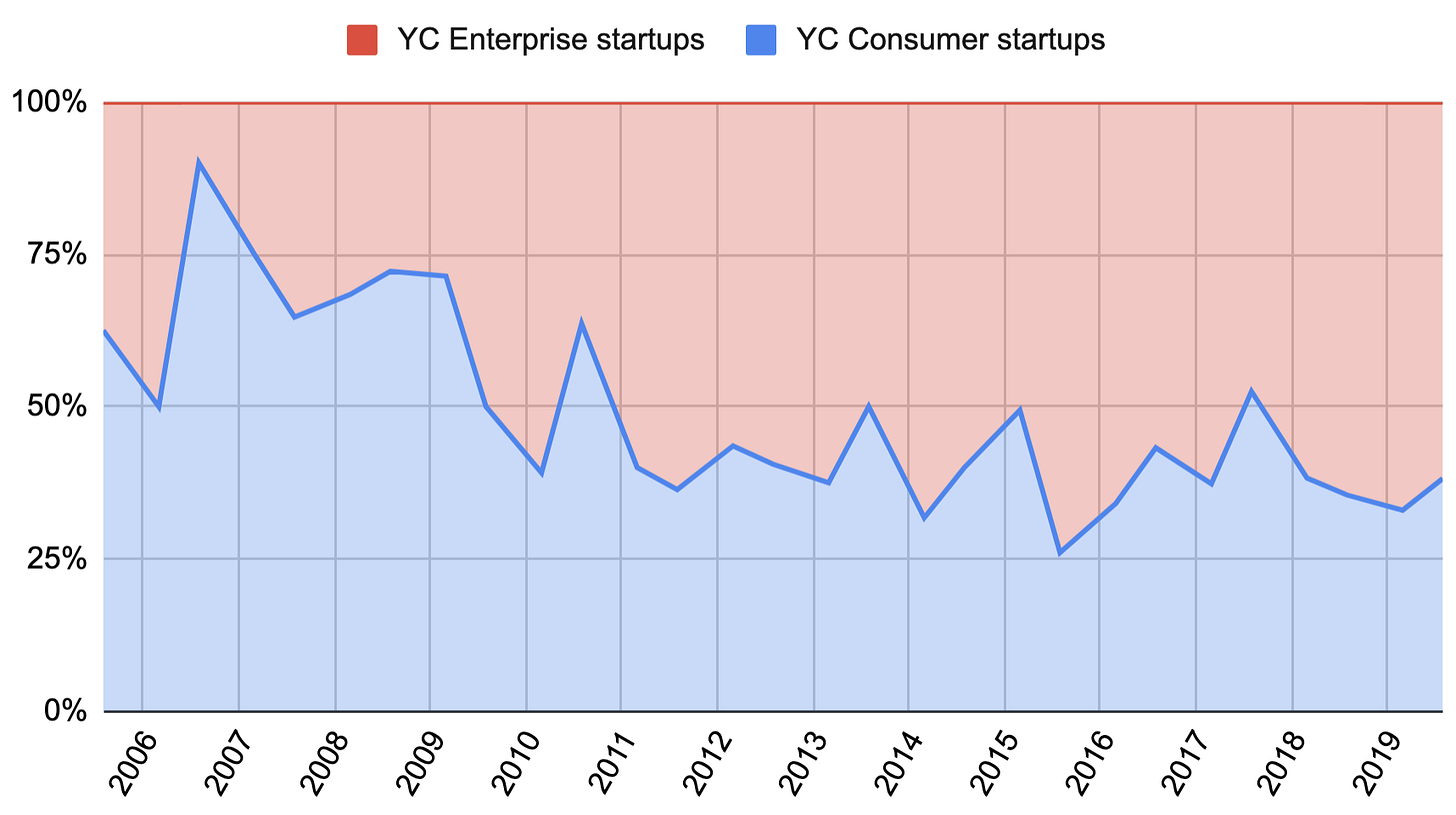

Enterprise > Consumer

According to new research done by Pitchbook, B2B has overtaken B2C in total investment. For the first time at the seed level, enterprise startup investment has overtaken consumer-focused investment. Interestingly, Eric Feng also used YC investment history as a proxy and found similar results. In the 2020s, will we see the enterprise space become bloated and eventually see the pendulum swing back in favor of consumer tech? (Source).

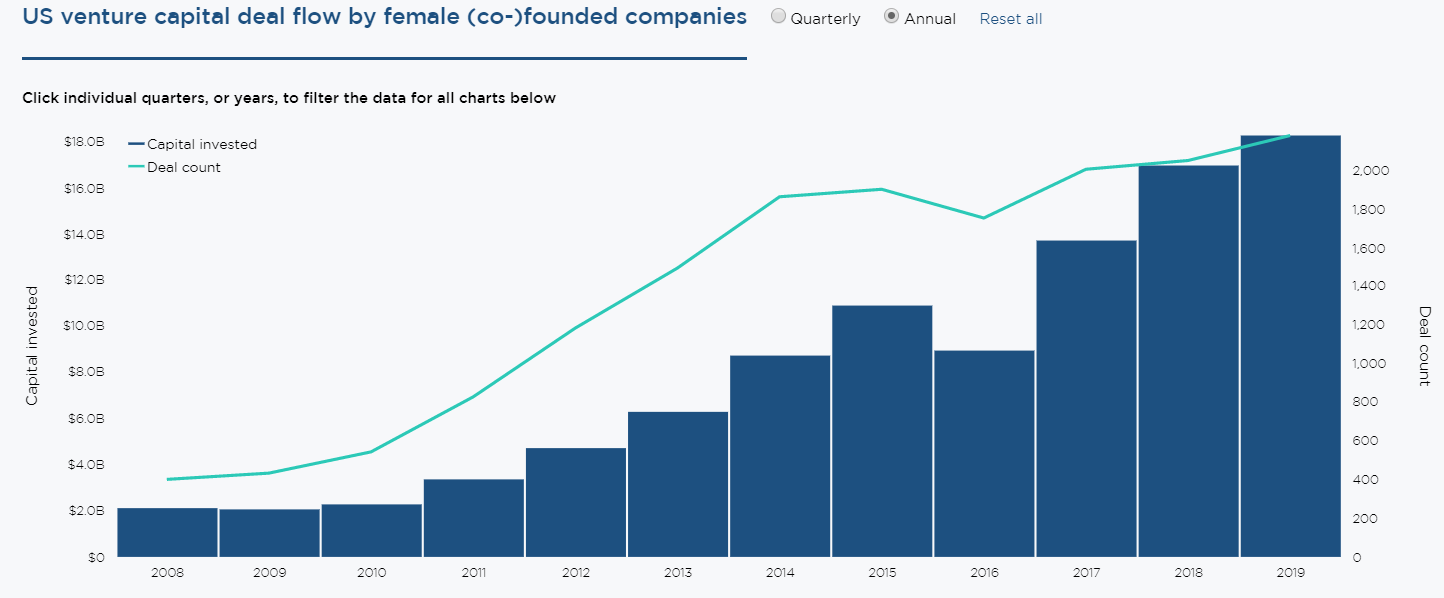

The Future is Female

Female investors are finally starting to get their fair seat at the table. Despite the most popular names in venture capital being David, Michael, and John, there is a positive trend nationally and in the Boston tech scene changing this. VC investment in all-female founding teams hit $3.3B in 2019, representing 2.8% of US venture capital. Read more in Carta’s gender equity gap study, Tide’s female founder data, and consider partnering with AllRaise.

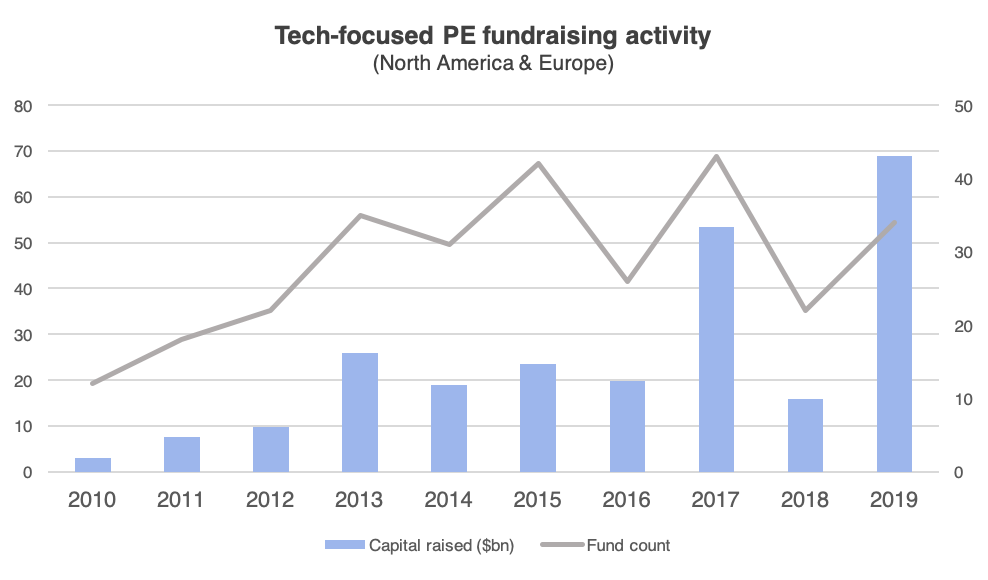

Looking back (and ahead) on the VC funding landscape

Blogger Torin Rittenberg sums up the 2019 landscape with some fascinating figures. Tech-focused PE funds raised a historical high. A record number of $100M+ “megadeals” took place this year. Non-traditional investors such as hedge funds, mutual funds, and corporations are here to stay. The seed market is still exploding. (Read it here)

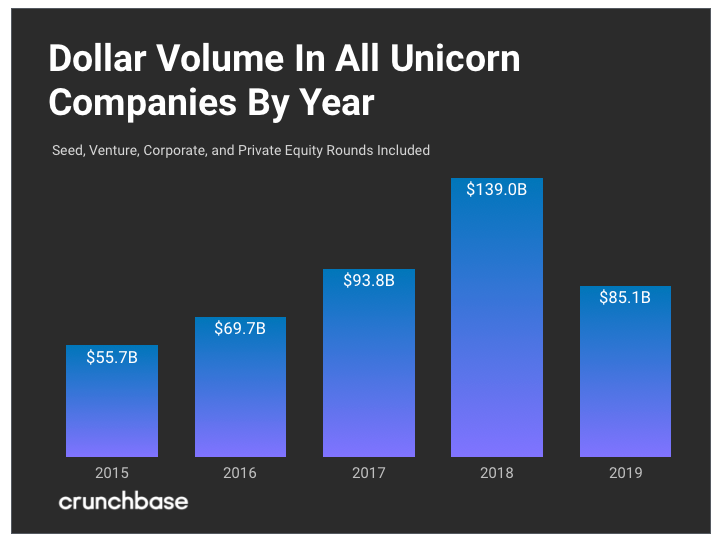

More Unicorns Birthed, and Soonicorns are Growing Quick

Across the globe in 2019, 142 startups raised $85.1B to achieve the coveted “unicorn status” of a $1B or more valuation. Of those 142, 78 were US-based companies. Surprisingly, unicorn companies in 2019 raised the least amount of capital since 2016. Who invests in the most unicorns? Insight Partners, Spark Capital, Tiger Global, NEA, and GV. (Source)

VC-Backed Discounts are Losing their Appeal

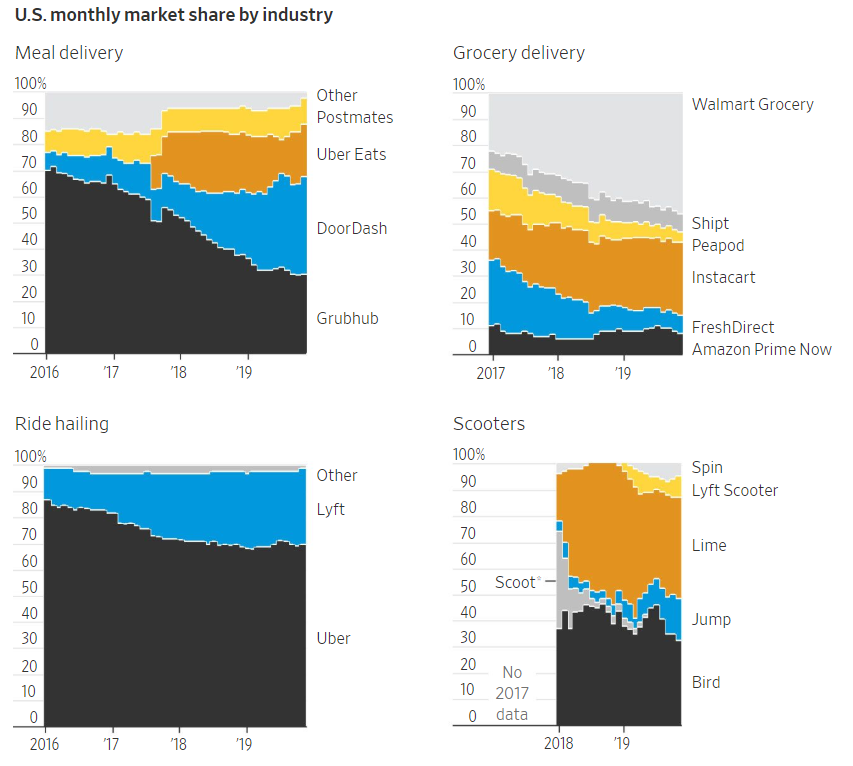

Although great for the consumer, startups can no longer subsidize the cost of services to users with VC money, stimulating artificial growth. Heather Somerville outlines how startups must think of a new approach to gain market share that doesn’t involve making things free. (Source)

The Great Public Market Reckoning

Building off of Dan Primack, Fred Wilson looks at the best and worst-performing tech IPOs of the year and teaches us a mindblowing new financial metric: Gross Margins. Yup, that’s right, it turns out that calling yourself a tech company doesn’t mean you magically scale like one. (Source)

“If the product is something else and cannot produce software gross margins then it needs to be valued like other similar businesses with similar margins, but maybe at some premium to recognize the leverage it can get through software. But we have not been doing it that way in the late-stage private markets for the last five years.”

CEO Shakeup

The last three quarters of 2019 represented a record-breaking year for CEO departures. The tech sector was hit especially hard, with 154 CEOs leaving their post before year-end.

IPOs: Is There a Better Way?

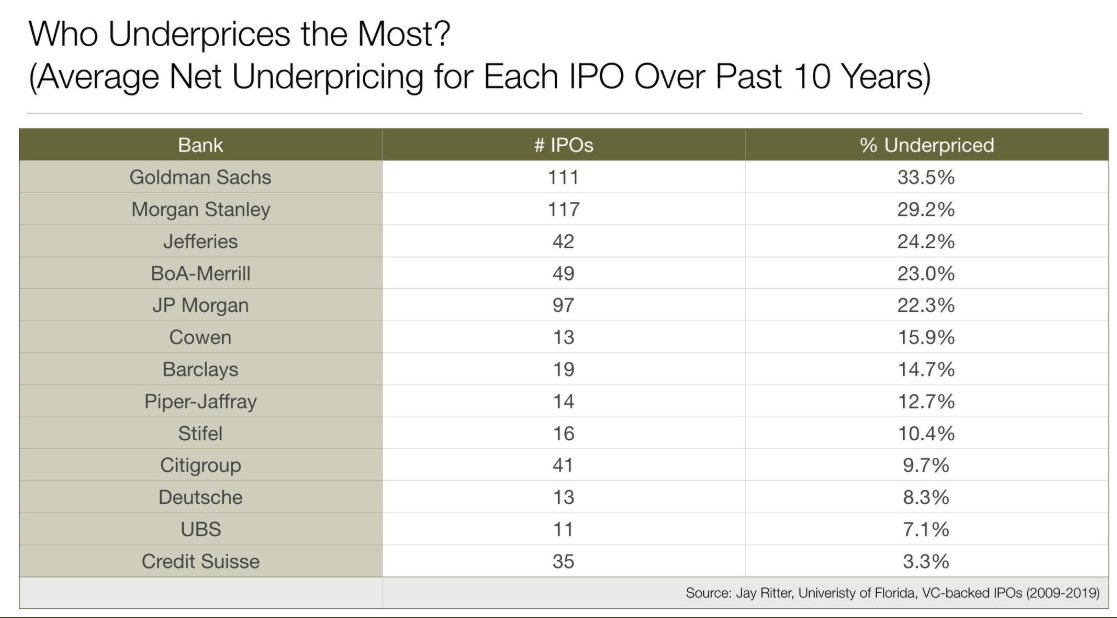

With Bill Gurley as their mascot, startups are experimenting with Direct Listings instead of the traditional IPO process. Why? Because the deal structure of a traditional IPO incentivizes investment banks to price an offering to make them the most money, as opposed to the founding team. The idea is gaining traction, with the NYSE submitting multiple proposals to the SEC to shift the landscape and allow private companies to raise money and do a direct listing. (Source)

Tech Flops of the Decade

This Verge piece had some forgotten gems and some products I honestly had never heard of that failed in the 2010s. Overall, I thought it highlighted the incredible risks that founders took over the decade and got me excited for what the 20s have in store.

That’s all from me. What did I miss? Comment or message me the articles that you think best summarize tech in 2019.