Welcome Back!

Thanks for tuning in for weekly updates on fundraising within the Boston tech ecosystem. My name is Nick Stuart and I’m a finance student at the University of New Hampshire. You can learn more about me here and about the student-run micro-VC I help run here. My goal is to provide more consistent coverage of the thriving Boston tech scene and learn more about it myself along the way.

Last week, ten tech companies raised $289M in Boston

First, Some Quick M&A Updates:

Tech VC Financing Deals:

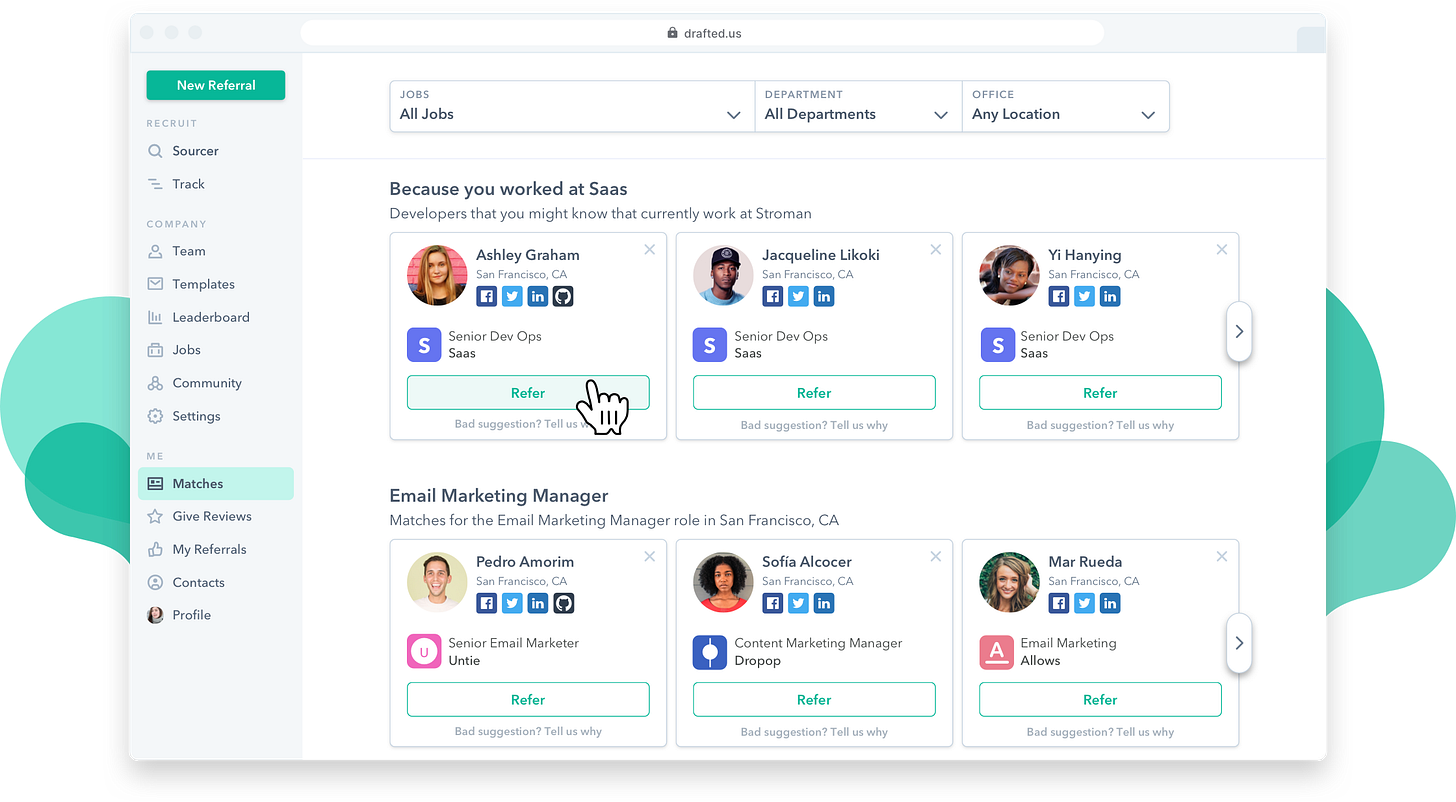

Cambridge-based recruiting platform Drafted has raised $2.77M from Slack Technologies (NYS:WORK), bringing their total raised to $5.26M. Drafted helps businesses find, qualify, contact, and track job candidates through an integrated platform. The product helps companies leverage their entire organization to find and vet new job candidates and integrates with other services such as Lever, Workable, Jobvite, and Taleo. Previous investors include Accel, General Catalyst, Lightspeed, Launch, Lola.com, and Boston Seed Capital & Boston Syndicates.

Image: The Drafted referral dashboard

Hometap raised a whopping $100M led by ICONIQ Capital, with participation from American Family Ventures, G20 Ventures, General Catalyst, and Pillar VC. Hometap is a platform that allows homeowners to receive cash for selling off the equity in their homes. Hometap then receives compensation for that equity when the house is sold. This marks their third round of venture funding, previously raising a $12M Series A from the same investors bringing their total raised to $114.5M.

Duck Creek Technologies, a SaaS platform offering technology solutions for property and casualty insurance carriers, has raised $120M in late stage private equity funding from Dragoneer, Neuberger Berman, Insight Partners, and Temasek. The company has reportedly grown its revenue by 32% YoY.

Thundra (the SaaS company not the Marvel super villain) has completed a $4M Series A funding round from undisclosed investors. The company’s software allows users to visualize and monitor their entire serverless environment. Around 15 months ago, they raised a $1.5M Seed Round from Battery Ventures.

Laudio has raised a $7.3M Series A from .406 Ventures, inHealth Ventures, and MemorialCare Innovation Fund, all who followed on from their January 2019 $1.75M Seed Round. Laudio is a “transformation leadership platform” designed to save healthcare managers time while increasing staff engagement. To combat the low retention and high burnout that occurs in with nurses, the company has created an evidence-based system for healthcare managers to better engage with employees.

Pet care and insurance platform Wagmo has raised a $3M Seed Round led by Harlem Capital and Vestigo Ventures, with participation from The Fund and Female Founders Fund. The company, operating out of NYC and Boston, offers membership-based coverage plans for as low as $15 a month that lessen the burden of routine and preventative animal care. Wagmo is a Harvard iLab, Techstars and Masschallenge Alumnus.

Per Bostinno, LinkSquares has raised $2.5M in debt according to an SEC filing. The debt facility comes exactly 12 months after their $4.8M Series A from Hyperplane Venture Capital and MassMutual Ventures. LinkSquares, founded in 2015, is an AI-powered contract analytics platform that helps businesses know the key liabilities within a contract before reading them. The software is used for crisis management, quarterly reporting, fundraising/M&A, and internal legal processes.

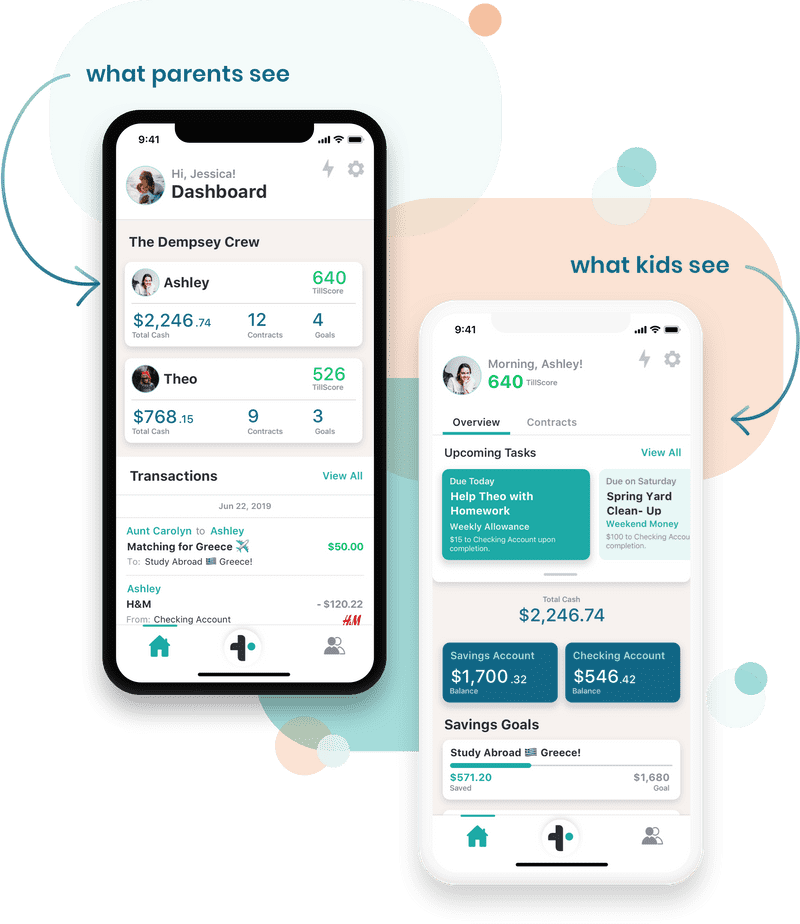

Nantucket-based Till Financial has raised $1.2M in Angel Funding from undisclosed investors. Led by Tom Pincince, Till is a year-old company focusing on helping kids be smarter with money. The mobile app aims to help children learn to spend, save, and invest with guidance from their parents. The app is currently in closed beta, but you can sign up for early access on their website.

Image: Screenshots of the Till Financial platform

AI-enabled live engagement platform Vee24 has secured a $5.24M Series C from undisclosed investors, bringing their total raised to $19.6M. The company specializes in live customer engagement solutions such as text/voice/video chat, co-browsing, and screen sharing to support brands in improving their customer experience. Previous investors include Boston’s Data Point Capital and Point Judith Capital.

Video and slideshow creation app Sharalike has raised $970K from undisclosed investors, bringing their total raised to $7.24M. Past investors include AngelSquare, Techstars, and Breega Capital. The eight year old company was previously featured on TechCrunch for their VR slideshow app. Sharalike is led by Aymeric Vigneras and produces several other apps, including OpenFrame, iBuyer, and V360.

Image: A screenshot of the Sharalike slideshow app

CareSyntax, an IoT connectivity solutions provider for operating rooms, has raised $45.6M from DDG Fund, IPF Partners, Relyens, and Whiz Partners in the same week that they acquired Syus. The later-stage company has now raised a total of $91.25M from over 18 investors. According to medtomarket, this funding will be used to accelerate US and international growth while developing new surgical intelligence and automation technologies.

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at www.nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.