Welcome Back!

Before we dig into deals from last week, I wanted to share some stats from the Pitchbook & NVCA Venture Monitor Q4 Report as well as BostInno’s summary of the report if you haven’t already read them. Some interesting highlights:

US VC deal count surpassed 2019 numbers at ~10K deals, and deal value took only a slight dip with a total of over $136B. With that said, Q4 saw a slowdown in deal count across all investment stages.

Early-stage deal sizes continue to climb to a median of $6.5M across 3.6K deals. As I wrote about two weeks ago, Boston’s total annual median deal size was $3M, but grew to $6M in Q4.

Last year, there were a record 237 “mega-deals” of $100M or higher. Boston accounted for just under 1% of these.

Boston is currently ranked third place for cities raising the most capital for all female-founded teams. When measured by deal count, Boston is ranked fourth.

Another interesting trend is the growing shift in time to raise angel and seed capital. Pitchbook reports that companies are waiting an average of 2.9 years to raise their first round of outside capital, up from 1.5 years in 2012. These “first-financing” rounds are happening less frequently as well, with more capital going into already venture-backed companies.

Nontraditional investors continue to increase their participation. Corporate VCs accounted for 50% of all deal value in VC deals with nontraditional investor participation. Salesforce Ventures, GV, Intel Capital, and M12 combined accounted for 224 deals in 2019.

Exit value in the US was almost double 2018’s with $256B+ in value generated in 2019. IPOs accounted for ~10% of all exits, yet ~80% of the total exit value was generated from them.

Also, if you’d like to learn more about New England startups that are raising right now, check out The Buzz newsletter. The Buzz is a new publication covering early-stage startups in New England that are active fundraising. Their goal is to connect them to investors and others in the entrepreneurial ecosystem that can help them progress in their entrepreneurial journey. If interested in learning more, check out The Buzz or email bb@ourbuzzmedia.com.

VC Financing Deals

Online insurance platform Insurify has raised a $23M Series A led by MTech Capital and Viola FinTech. Insurify uses AI to help customers find the amount of coverage that is appropriate for their situation. Users can enter their location and information about their vehicle, home, or life insurance and immediately get relevant rate comparisons. According to TechCrunch, they plan to use the funding to expand their presence in new insurance verticals.

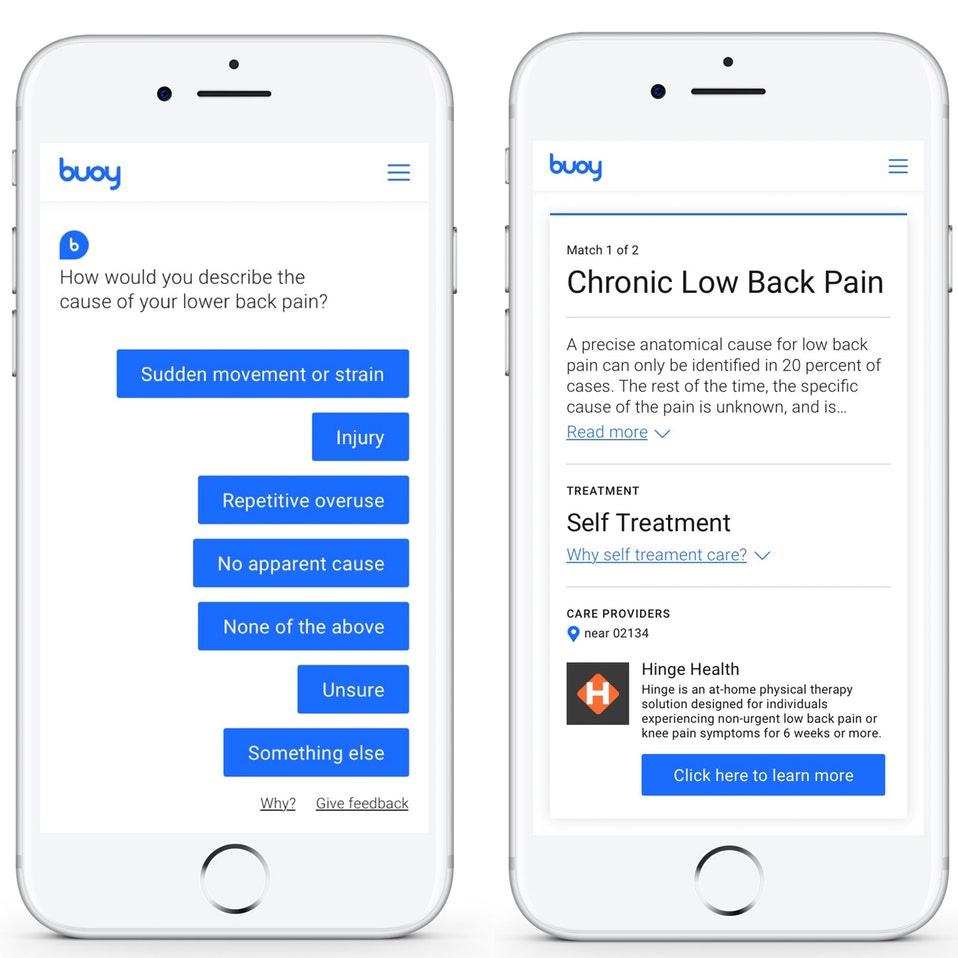

According to Finsmes, Buoy Health has closed the last of its $20M Series B with an investment from Cigna Ventures. The round was led by Hambrecht Ducera Growth Ventures, with participation from Humana, F-Prime Capital Partners, and Optum Ventures. Buoy uses a simple AI-powered questionnaire called the Symptom Checker to provide users with options for clinical support. They sell to employers to help employees get quick answers to their health problems and reduce non-emergency ER visits.

Image: Screenshots of Buoy’s AI-powered health assistant.

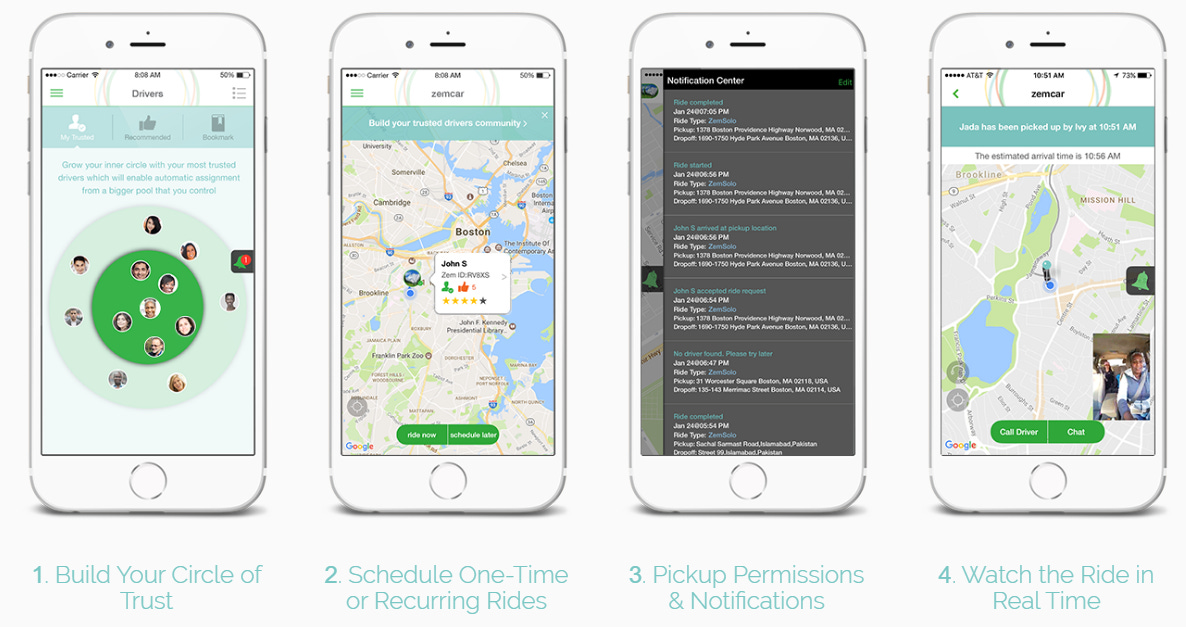

Ridesharing platform Zemcar has raised $300K in Angel Funding, bringing its total raised to $1.3M. How are they different from Uber and Lyft? According to their website, by building the product around safety features. The app allows users to build a close circle of trusted drivers (that can even be interviewed), schedule recurring rides, and provides real-time audio, video, and text updates for ride progress to authorized family members.

Image: Screenshots of Zemcar’s mobile app

Arcadia.io just completed a $29.5M Growth Equity round from Cigna Ventures. Arcadia is a software company that helps healthcare organizations acquire and analyze medical record data. According to the Boston Business Journal, the company had 100 employees and did $45M in revenue in 2019. The battle for access and control to medical records is heating up, as big tech firms look to modernize the process. Check out WSJ’s latest podcast on why companies like Google are pushing into the same space as Arcadia.

Acton-based Spero Devices has raised $1.1M in debt, following their last $1.5M grant from the US Department of Defense in 2017. The company previously participated in the MassChallenge 2016 cohort. Spero is developing a more efficient way to compute data in extended reality “XR” applications, which typically requires collecting and processing massive amounts of spatial, visual, and biometric data in real-time. From what I understand, Spero focuses on fixing this by producing specialized processors for computing this data on a mobile device instead of an expensive computer.

MarTech and content management company Skyword is closing a $5M equity round, following an $8M growth equity investment in October of 2018. The 16-year-old company has now raised over $100M in equity and debt in its mission to help brands efficiently manage content marketing, social analytics, and talent acquisition.

Sweden and Boston-based Funnel just closed a $47M Series B co-led by Eight Roads Ventures and F-Prime Capital, with participation from Balderton Capital, Oxx, Zobito, Industrifonden, and Kreos Capital. The company makes it easy for enterprises to collect and normalize data from over 500 marketing channels so they can feed the data into any analytics tool of their liking. According to TechCrunch, the funds will be used to expand the company’s US presence and grow its technical team.

Rev’d, an indoor cycling brand with four locations in MA, raised a $200K Angel Round. Led by Northeastern alum Meaghan St. Marc, Rev’d operates indoor cycling studios that offer access to 45-minute workout sessions for $30/mo. Riders can work out alongside their team of 29+ trainers. Related: Wahlberg-backed F45 Training files for IPO.

EQRx, a startup developing cheaper clones of popular medicines, has officially launched with a $200M Series A backed by GV, Arch Venture Partners, a16z, Casdin Capital, Section 32, Nextech, ARCH Venture Partners, and Arboretum Ventures. According to Startup News, the company is, “focused on re-engineering the process from drug discovery to patient delivery with the goal of offering a market-based solution for the rising cost of medicines.”

Real Estate tech company Bldup has raised a $75K round of Angel Funding. The company collects and publishes data on construction, design, and real estate projects for market intelligence or prospecting purposes. It helps consumers and real estate developers see what’s being built in their neighborhood by collecting data from various sources. They currently have data feeds for Boston and D.C. The company is led by Noah Coughlin and has 16 employees according to Linkedin.

Image: Bldup’s recent real estate intelligence updates.

ReadCoor, a company re-imagining genetic spatial sequencing, has raised a $27M Series B from Pavilion Capital, with participation from Decheng Capital and Hansjörg Wyss. Spatial sequencing is a technology that allows scientists to measure all gene activity in a tissue sample and map where this activity is occurring. However, this sequencing process currently requires scientists to grind genetic samples into fragments, which removes spatial data associated with the sequence. This spatial data is important because it can identify molecule coordinates in tissue to help understand the relationship between specific molecules and cells. ReedCoor tackles this problem by using fluorescent in situ sequencing (FISSEQ) technology that displays this data in the form of 3-D panomic readouts to capture all cell activity, no grinding or fragmentation necessary.

Image: Footage showing mouse lung tissue taken using FISSEQ.

Newstore, the platform helping retailers run their stores entirely on their iPhone, just raised $20M led by Salesforce Ventures with participation from General Catalyst and Activant Capital, bringing their total raised to $129M. Newstore helps retailers understand their customer base and inventory with a variety of tools that empower store associates to manage inventory, close sales, and track customer activity.

Image: Newstore’s mobile application

Concerto HealthAI, a precision oncology data and research platform, just raised a $150M Series B led by Declaration Partners. Concerto focuses on using AI to analyze patient data to evaluate health outcomes, improve research, compare treatments, and develop new drugs. Their platform enables healthcare providers to monitor self-reported patient data at the point-of-care and in-between visits to improve the likelihood of the right patient getting the right medicine.

CiBO Technologies has raised $7.15M from undisclosed investors, bringing their total raised to $45M. The AgTech company uses various data feeds to generate insights about the value, productivity, stability, and sustainability of farmland. Using CiBO’s website, users can map out acres of farmland and arrive at data-backed valuations for land parcels.

Image: Screenshot of CiBO’s land explorer tool.

App development platform PF Loop has raised a $346K Angel Round to develop its pSnap suite of products. According to its website, PF Loop’s goal is to create software and services that make people more positive. Although it sounds like your typical vague mission statement, this appears to literally be the whole idea behind the platform. It’s a collection of oddly themed, expensive-yet-generic-looking apps including gratitude journals, relationship guides, goal setting apps, whatever this is, and an app that helps you text yourself a picture of your own smile to stay positive.

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.