How do you Read Newsletters?

It's an honest question, even though it might sound obvious. It's hard to keep up with them, and they're a pain in the ass if you haven't figured out the perfect way to organize your inbox. Lots of people think the “everyone having a Substack” fad will die. I think it's more of a proper consumption problem.

It took me a while to figure out a good system, but I’ve converted to Stoop. It's a slick mobile and web app that creates an inbox-style feed for your newsletters where you can view, save, and forward them. I try to check it every morning. I'm in no way affiliated with the company, it just helped me crack my newsletter reading workflow and helped me consistently follow a lot of good writers. Some of my favorite lesser-known newsletters:

Snow Thoughts

An unfiltered view of macroeconomics, crypto, and tech investing from Boston’s Matt Snow. Frequently covers why the money printer goes brrrr and WTF happened in 1971.

Everything

A brand new merger of premium Substack publications that I reference frequently. It focuses on productivity and business strategy. I shared Nathan Baschez’s Inside the Clubhouse article not long ago.

Witty Wealth

A new MorningBrew-esque newsletter that covers finance topics using simple words and pop culture references. It seems like a joke at first, but Anuj Abrol puts in an absurd amount of research into each issue. See his Game of Thrones-themed Who is Chamath Palihapitiya for a taste.

Not Boring

Business strategy takes, but not boring. Here’s why author Packy McCormick thinks Business is the New Sports.

The Venture Desktop

Brett Bivens writes some excellent deep dives on the innovation economy. For a taste, check out The Merits of Bottoms Up Investing.

Please feel free to send me anything you’re regularly reading…I’d love to check it out!

Other Stuff I'm Reading:

VC Financing Deals:

Whatifi 📺

As Quibi closes a lackluster end to its $1.75B free trial period, another short-form video service has emerged. Whatifi is a new choose-your-adventure social app based out of Wellesley and Los Angeles. The app makes it easy for friends to vote on the plotline of short movies while watching together. They just raised $10M from Andreesen Horowitz, Matrix Partners, the ex-CFO of Netflix, PayPal co-founder, Zynga founder, ex-Lyft COO Jon McNeill, and others. It’s founded by Hardi Meybaum (ex-GP at Matrix Partners), Jaanus Juss (Estonian technologist), and Michael Offill. The team is building a social-oriented version of interactive media that we got a taste from with Bandersnatch on Netflix and those Goosebumps books from the 90’s.

Vendr 💰

Last October, Boston’s Vendr made headlines by raising a seed round while already profitable. The YC alumnus is building software that identifies potential cost savings on software purchases for enterprises. Kind of like an enterprise version of Honey. After getting backing from F-Prime Capital, Sound Ventures, Liquid 2 Ventures, and Garage VC, their new $4M round has been led by Craft Ventures. TechCrunch outlines how Vendr made the typically difficult switch from a consultancy firm to a high-margin software business.

Trade Hounds 👷

In mid-May, I wrote about Cambridge-based Hardworkers raising $150K for its trade work social media platform. Last week, a similar product out of Boston called Trade Hounds raised its third round of venture financing with $3.2M from Brick & Mortar Ventures and Corigin Ventures. They’re previously backed by Hyperplane VC, according to Crunchbase. Trade Hounds is a free mobile app aimed at connecting the tradespeople of America through an Instagram-style feed where users can share projects. The company is founded by David Broomhead and Peter Maglathlin (co-founder & ex-CFO of Catalant Technologies). They’re currently hiring for several roles.

Quaise ⛏️

Quaise just launched out of The Engine with $6M in funding with participation from Collaborative Fund. The startup, which spun out of the MIT Plasma Science and Fusion Center, is building drilling technology that will allow them to dig 10-20 kilometers below the earth’s surface to harness geothermal energy. Apparently it’s pretty hard to dig much farther than 40,000 feet below the earth’s surface. It took the Russians 20 years to get there. The founders learned that the bottleneck lied in building an effective drillbit. They’re opting to use electromagnetic waves to blast through the earth’s crust more effectively.

Duck Creek Technologies 🛡️

Four-year-old InsurTech firm Duck Creek Technologies has raised $230M ahead of an anticipated IPO. The new investors include Kayne Anderson Rudnick and Whale Rock Capital. Back in December, I wrote that the company had raised $120M from Dragoneer, Neuberger Berman, Insight Partners, and Temasek. The company provides a suite of software tools for the property and casualty insurance industry for assistance with policy administration, billing, claims, and more. More from BostInno.

Kyruus 🏥

Kyruus, a healthcare software company founded in 2010, just raised $30M from Francisco Partners. They provide search, scheduling, and data management solutions for patients and providers. The company’s software improves patient access to data with a suite of products for access centers and website & app development. More from BostInno.

PatientPing 👩⚕️

PatientPing, the seven-year-old healthcare coordination company out of Boston, just raised a $60M Series C. The round was joined by Andreessen Horowitz, F-Prime Capital, GV, SV Angel, and Transformation Capital. The company has a suite of products aimed at improving all healthcare encounters between patients and providers. Their software can be integrated into existing hospital infrastructure to help providers better track and engage patients with advanced notifications, dashboards, and gain helpful context around patients.

Appfire 💻

In its first round of outside capital, Boston’s Appfire just raised $49M from Silversmith Capital Partners. The 15-year-old company manages a portfolio of applications that enhance the customer experience of popular Atlassian tools. They have purchased developer brands like Feed Three, Bob Swift, and Wittified and sell their products under the Appfire brand through the Atlassian marketplace.

CareAcademy 🧓🏼

Senior care company CareAcademy just raised $9.5M to train more nurses. The company is building a platform for online training for caregivers so senior care providers can quickly onboard new workers and keep them in compliance in all 50 states. According to Crunchbase and Axios, the round was led by Impact America Fund with participation from ReThink Education, Revolution Rise of the Rest, Wanziang America Healthcare, Techstars, Strada, and ECMC. The company is founded and run by Helen Adeosun.

Infinidat 💽

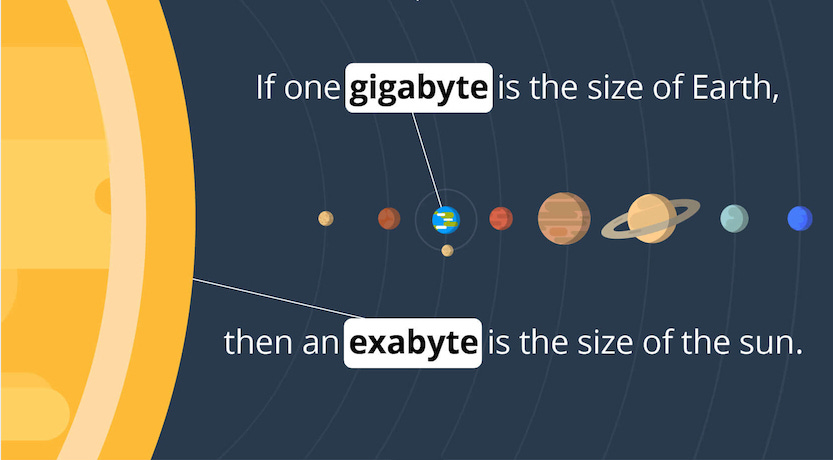

Data storage unicorn Infinidat has raised a new growth equity round from TPG Growth, Goldman Sachs, Claridge, and Ion Investors. The nine-year-old company focuses on providing massive-scale data storage solutions to large enterprise customers in telecom, banking, and cloud services. Their platform has already shipped over 6 exabytes to customers around the world and has raised $325M+ in capital.

Wonderment 📈

According to a tweet from co-founder Brian Whalley, pre-launch Wonderment has closed a new round of funding. The Boston-based eCommerce customer retention platform is still in private beta and but is seeking to grow its three-person team.

JSonar 🔍

Database security platform jSonar just raised $50M from Goldman Sachs after previously raising $10M across two rounds from Cedar Fund since launching in 2013. The company uses AI to analyze massive amounts of database activity to detect threats and recommend proper security protocols.

Thanks for reading!

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.