Welcome Back!

It seems like every other day there’s another robotics company raising a massive round of venture funding. Just last week, Soft Robotics and Berkshire Grey raised a combined $73M and Vecna Robotics raised $50M the week before.

Before diving into recent funding rounds, I wanted to look back at some of the top robotics exits in Boston. If you’re interested in learning more about robotics companies in Massachusetts, check out Builtin Boston’s robotics companies list and MassTech’s Robotics Cluster.

Top Robotics Exits in Boston

Corindus Vascular Robotics

Last year, Siemens bought the precision cardiovascular robotics platform Corindus for $1.1B in cash.Kiva Systems

Back in 2012, Amazon purchased Kiva Systems for $775M to bolster their fulfillment center automation abilities.nuTonomy

In 2017, Delphi purchased autonomous vehicle software developer nuTonomy for $454M.6 River Systems

Last September, Shopify purchased the warehouse automation startup 6 River Systems for $450M to grow its fulfillment network.Endeavor Robotics

In early 2019, Oregon-based FLIR Systems bought military robot producer Endeavor Robotics for $385M in cash. The company was originally an iRobot spin-off that was picked up by a PE firm in 2016 for just $45M.AutoGuide Mobile Robots

In the fall of 2019, Teradyne purchased AutoGuide Mobile Robotics for $165M. AutoGuide makes high payload autonomous mobile robots (AMRs) that are modular and adaptable to many operational workflows.ReWalk Robotics

Rewalk IPO’d in 2014, raising $36M in capital. The offering priced its stock at $12 per share, bringing the company value to $136M.OceanServer Technologies

The developer of unmanned underwater vehicles for defense, commercial, and research purposes was acquired by L3 Technologies for $118M in 2017.iRobot

The consumer robotics company IPO’d in 2005 for $115M.Boston Dynamics

Back in 2013, Google had purchased the quadrupedal and bipedal robot maker for an unknown price, only to sell it to SoftBank in a corporate divestiture for a reported $100M in 2017.

If you’re reading this for the first time, welcome! My name is Nick Stuart and I write a weekly newsletter on tech VC financing trends in Boston. You can learn more about me on my website here and about the micro-VC I help run here.

Moving on to VC Financing Rounds

Soft Robotics has raised a $23M Series B led by Calibrate Ventures and Material Impact, with participation from Honeywell, Yamaha, Hyperplane, ABB Technology Ventures, FANUC, Mark IV Capital, Scale Venture Partners, and Tekfen. Soft Robotics is the developer of modular gripping mechanisms that can be adapted to a variety of industrial needs. Now armed with over $54M in total capital raised, the company plans to focus on expanding into new verticals like food packaging, e-commerce, and logistics.

Image: The Soft Robotics mGrip in action

Berkshire Grey, another robotics company, just smashed Boston robotics fundraising records with a $263M Series B round of financing, bringing their total capital raised to $280M. The company builds software and hardware for autonomous fulfillment systems in retail, e-commerce, and logistics. This is easily the largest venture funding round for a robotics company in Boston, with Vecna robotics coming in second at $50M. According to Axios, multiple sources claim that SoftBank had originally offered to buy the company before this deal was settled. The seven-year-old company has already raised eight times as much capital as Kiva Systems did prior to their $775M acquisition.

Image: One of Berkshire Grey’s modular mobile robots.

Burlington, MA-based data security startup Privafy has just launched and raised $22M out of the gate. The company offers a cloud-native “Security-as-a-Service” solutions to protect businesses from intrusions, malware, DDoS attacks, ransomware, and other cyber threats through a “secure private network on the public internet.” The company was launched by ex-Verizon executive Guru Pai and ex-NXP Semiconductors CEO Rick Clemmer.

Serverless tooling startup, Thundra, just announced a $4M Series A led by Battery Ventures, with participation from ScaleX Ventures, Berkay Mollamustafaoglu, and NH-based York IE. The company spun out of on-call management technology company OpsGenie in 2018. The company’s goal is to enable businesses to view all parts of their serverless application to understand performance issues. According to Linkedin, they currently have 14 employees across Boston and Turkey.

Outcomes4Me has raised $4.5M in a combination of debt and equity from undisclosed investors. The company has developed a mobile application to help guide breast cancer patients through the complex treatment process. The app helps empower patients to make well-informed decisions regarding treatment or clinical trial opportunities related to breast cancer. It is led by ex-Celsius Therapeutics COO Maya Said.

Image: Screenshots of the Outcomes4Me mobile application.

Seven-year-old Catalant Technologies has raised $35M in Series E financing. Catalant is a software company that helps businesses effectively execute their strategies using a consultant marketplace as well as their new One Platform. The company’s platform helps put data and metrics behind strategic decisions to study the potential outcomes of new and existing company projects. The deal was led by Goldfinch Partners, with participation from ZX Ventures, Salesforce Ventures, and SJF Ventures. Past investors include General Catalyst, Highland Capital, GE Ventures, Mark Cuban, and others.

QMENTA, a Boston-based medical imagery startup, has raised $1.2M in equity crowdfunding on Capital Cell. The company has created a platform to “manage, share, and analyze image data in one single AI cloud-based system.” They focus on improving outcomes for drug development and clinical care methods specifically for brain diseases using their advanced neuroimaging data management and analysis platform. According to Linkedin, they have 28 employees.

Cobu, formerly known as Doorbell Communities, has raised a Seed Round led by Beni VC. Cobu is a real estate tech firm that aims to drive a sense of community among apartment tenants. They focus on fostering in-person event experiences, digital engagement, and data analytics for landlords to “increase resident retention, referrals, and apartment differentiation.” The sixteen-person company is led by Benjamin Pleat

Image: Screenshots of Cobu’s mobile application

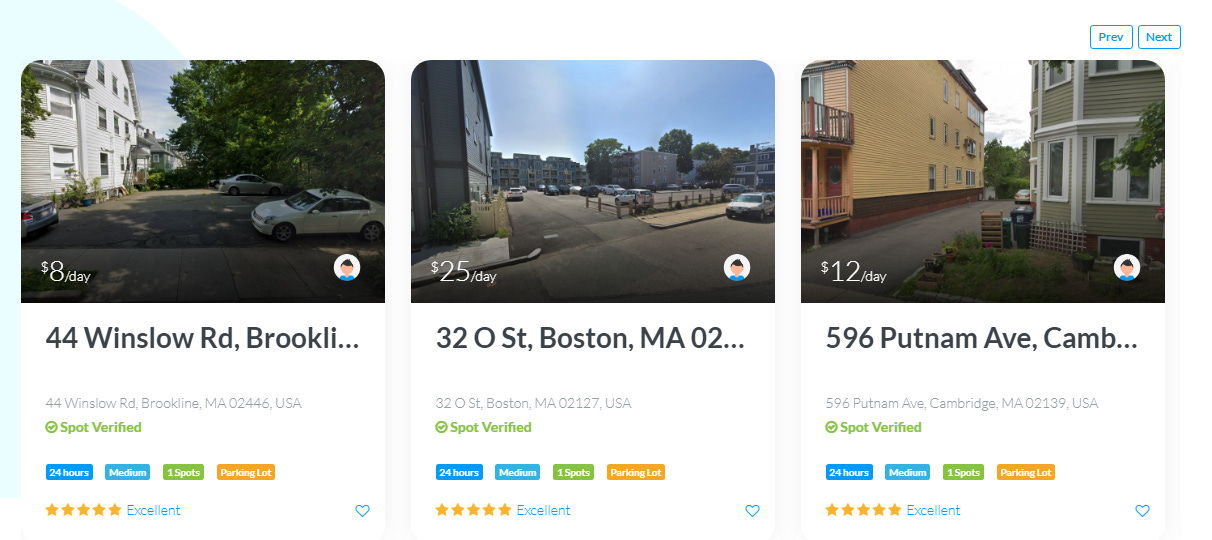

Parkaze, an online community for hosting and renting privately owned parking spots, has raised a pre-seed round of $30K from a Texas-based accelerator program called Wildcatters. Parkaze is led by BU alumnus Amal Radhakrishnan. I’m curious to test out this product as I have tried several alternatives and have been following the up-and-coming AirGarage for some time now. It seems like this has always been one of the first “Uber-for-X” ideas that comes to people’s minds, yet there’s still no household name that has perfected it.

Image: Screenshots of the Parkaze website showing lot listings.

Vincere Health has received $36K fresh out of the Alchemist Accelerator. Last year, they also received funding from the Harvard Innovation Launch Lab. Vincere, meaning “to win or overcome” in Italian, partners with insurance companies to pay smokers to quit using a mobile app and cig-sensing breathalyzer. It’s kind of like the Progressive Insurance Snapshot device, but for your lungs. They use “incentives, behavioral nudges, and evidence-based interventions to help you quit smoking and make healthy choices.” According to TechCrunch, their total capital raised is $400K.

Image: Screenshot of the Vincere Health mobile application.

Nanotech company Nano-C just raised $9.8M in debt and loans from the Massachusetts Development Finance Agency and others, following an $8M Angel Round they completed 13 months ago. Nano-C creates nanostructured carbon materials for energy and electronic applications. The materials are a mix of fullerenes, carbon nanotubes, and fullerene derivatives.

eClinical Solutions has received development capital of an undisclosed sum from Summit Partners. The fourteen-year-old company develops clinical trial software that helps life science companies integrate all of their data sources.

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.