Welcome Back!

With one week left in the calendar year, US investors are squeezing in their final investments before the holidays leading to a year that closely rivals 2018’s record-breaking investment numbers. More to come on this as the final numbers roll in next week. Shoot me a message with any insights you’d like to see about Boston tech investment in 2019.

As for Boston, we had 17 companies raise $329.75M last week

Image: VC investment in the US, source: Pitchbook

For any first-time readers, welcome! My name is Nick Stuart and I write a weekly newsletter on tech VC financing trends in Boston because I feel the city deserves more coverage. You can learn more about me here and about the micro-VC I help run here.

Some Quick Updates:

MassChallenge announced their FinTech and HealthTech cohorts for 2020.

Read all about them here.Care.com is being acquired by IAC in an all-cash deal valued at $500M.

VC Financing Deals

CallMiner, a customer interaction and analytics company, just raised a $75M Series E led by Goldman Sachs, setting their valuation at $200M. The company has now raised $145M across five venture rounds. The CallMiner “Eureka” platform uses AI&ML to analyze all customer interactions across every communication platform to uncover “actionable intelligence.”

PropTech firm HqO just raised a $34.2M Series B led by Insight partners on an $80M valuation, with participation from Accomplice, Allegion Ventures, and others. HqO provides a platform to revolutionize the tenant experience for commercial real estate firms. They aim to the be “universal remote for office buildings.”

Roboworx, creator of the first autonomous snowblower, has initiated their indigogo crowdfunding campaign with a goal of closing a $150K round by the end of the month. They currently have $6K raised. The company was founded by engineer Bachir Kharraja in 2015.

Image: The Roboworx snowblower: SNOWBO.

Quantiphi, a AI and big data platform for media, insurance, healthcare, CPG, and more, has raised $20M from Multiples Alternative Asset Management. The Marlborough-based company has now raised over $23M. According to LinkedIn, the company already boasts over 950 employees and has additional offices in Bengaluru and Mumbai.

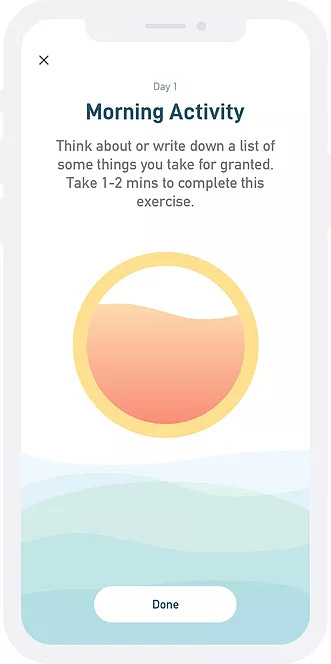

Prezence, a mindfulness and meditation upstart, has raised $35K in Angel Funding according to an SEC Form D. The company provides B2C and B2B digital wellness services that encourage users to spend more time in the present moment via a mobile app.

Image: Screenshot of the Prezence app

Covalent Networks has raised $6M in venture funding. The company’s solution improves on-the-job training (OJT) with a mobile and web based platform. Their mission is “To enable economic self-reliance by equipping people with in-demand skills.” They were part of the Harvard i-Lab in 2018 and raised their current round from Nimble Venture Partners and Pear.

Cambridge-based Sunu has announced a new crowdfunding campaign on Republic that has already raised around $2K. Sunu creates a wearable device aimed at empowering the blind and visually impaired to live independent lives. The Sunu Band allows people to gain a new echolocation-like sense. Using a mobile app, high frequency audio, Bluetooth, and a haptic feedback mechanism, the device helps the visually impaired “see” up to 16 feet away.

Image: The Sunu Band wearable echolocation device

Crowdfunding platform WeFunder just raised $5.13M to be the kickstarter for investing. Founded in 2012, the B Corporation is enabling “Everyone to invest in startups they care about.” With $16M in total funding, the company plans to continue its growth past its current $110M in startup investments raised.

Cannabis giant Ascend Wellness Holdings just raised a $45.43M round of funding to expand their retail and cultivation capabilities, bringing their total VC funding to $140M. According to Pitchbook, the funding round comprised a $37-million bridge round of preferred equity and $18 million in a senior secured note.

Neurable has raised a $6M Series B from Innospark Ventures, Loup Ventures, M Ventures, and Point Judith Capital, bringing their total raised to $14M. The company is creating a “New interface between humans and computers” using an EEG connected virtual reality helmet. The device detects brain signals, tracks eye movement, and provides software to interpret findings for a variety of applications.

Image: Neurable’s VR headset

Healthcare analytics platform OM1 just secured a $50M Series C led by Scale Venture partners, with participation from General Catalyst, Polaris Partners, and 7wire Ventures — bringing their total raised to $91M. OM1 provides an AI-driven platform meant to optimize patient outcomes in a hospital setting.

Boston-based Sofregen has raised an $8.1M Series B led by Anzu Partners to commercialize their silk protein treatment of vocal fold insufficiency, which is essentially a chronic hoarse voice caused by paralysis of the vocal folds. Sofregen’s treatment will utilize silk-based biomaterials to reposition paralyzed vocal folds. If you don’t have a weak stomach and want to see what current treatment methods looks like, YouTube Vocal Cord Medialization.

Woburn-based Energy storage company Vionx Energy has raised $30M in convertible debt funding, bringing their total raised to $100M. The company’s Vanadium Redox Flow Battery provides durable, long-lasting energy storage for renewables, EV chargers, microgrids, and more.

Image: A rendition of a Vionx’s energy storage system

Podimetrics, developer of a floor mat aimed at preventing diabetic foot ulcers through temperature monitoring, has raised a $16.55M Series B1. The company has now raised over $27M from investors such as Polaris Partners, Koa Labs, Norwich Ventures, and Rock Health. The Podimetrics RTM system includes an IoT foot mat for scanning foot temperature paired with a web-based application for clinicians to analyze results. Diabetes is the leading cause of lower extremity amputations in the US and approximately 14-24% of those with diabetes who develop a foot ulcer will require amputation. With 30M+ diabetes patients in the US alone, that equates to 4-7M amputations.

Image: The Podimetrics RTM (Remote Temperature Monitoring) System

LineVision raised $2.3M in convertible debt from undisclosed investors, bringing their total raised to $4.3M. The company offers a cloud-based transmission line monitoring solution for electric utilities. Their technology helps monitor power flows and rate the quality of electric transmission lines.

1336 Technologies has announced an $18M Series E led by Breakthrough Energy Ventures, bringing their total raised to over $293M. The company develops photovoltaic technologies that decrease the cost of producing solar modules by up to 40%. They’re able to build silicon wafers for solar panels (one of the most expensive components) in just 15 seconds with a new system called the “Direct Wafer Process.

Prodperfect has raised a $13M Series A led by Anthos Capital. The company has built a platform that uses live traffic to build, run, and maintain Q&A testing for web applications. Founded just 11 months ago, the company now boasts dozens of customers that utilize its fully automated end to end test development and maintenance product.

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.