Greetings!

If you’re wondering what it’s like to be quarantined on a college campus during the last leg of your senior year, just picture me setting up a third Xbox in my living room and eating bunless hot dogs for lunch. It’s depressing, but a lot of people are in much worse situations. Please consider donating your time or money to those helping on the front lines of this crisis. Let’s all continue to do our part to part so we can get back to our normal lives as soon as possible!

Investors Wanted 💸

Thank you to those who reached out with feedback regarding a private group for New England VC-related conversations. I got a handful of responses and will continue to revisit the topic. As it turns out, an investor friend of mine was already in the midst of making something similar to this. The group is already represented by the likes of Launchpad Venture Group, Flybridge Capital, 10x Venture Partners, Wasabi Ventures, The Rines Fund, York IE, and several other individual angels.

If you’re interested in becoming a part of the New England Investors Slack Community, please fill out this form. They’re hesitant to include a “magic link” because of potential scammers and to maintain high-quality membership. For the time being, the plan is to limit entry to currently active angels and VCs in New England only, as decided by the admins of the group (not me). As the community grows, they’ll start to expand those limits. Let’s come together, make friends, and get some cash into some fantastic startups during these crazy times!

How will the Pandemic Affect Boston VC?

I had the chance to connect with several investors throughout the week to talk about how COVID-19 is influencing their firm’s activity. Some of the similar themes I heard across conversations:

“It’s business as usual. We’re writing the same amount of checks and having the same amount of conversations.”

“We’re laser-focused on helping current portfolio companies cut burn and extend their runway, but passively keeping new deal conversations alive.”

“Most VCs have underestimated the seriousness of the situation. This will change the fundraising environment well into 2021 at the early stage. We are expecting to significantly cut back our deal volume.”

“The effect of the virus has been far more serious on our portfolio companies than any other economic downturn, and most active deals are falling through.”

I’m curious if anyone else has differing thoughts. Drop me a line if you’d like to chat about the local venture landscape and what your firm is doing to prepare. I also saved a few interesting Twitter threads on fund/portfolio management topics from Fred Destin, Erik Torenberg, Jason Lemkin, and Eric Paley. If you’re a subscriber to The Information, they’re having an exclusive video Q&A this week on How COVID-19 is Upending Venture Capital Deals led by folks from Tribe Capital, Hustle Fund, and Lux Capital.

Many journalists and analysts are also starting to consider what the outbreak might mean for VC-backed companies or startups raising their first rounds of capital. Some are looking to secondary market data for drops in valuations as exits are delayed and the stock market reprices tech. Meanwhile, CBInsights has gathered data on how COVID-19 is already impacting fundraising among traditional and corporate VCs.

What are things looking like in Boston so far? I first dug into Pitchbook to see if there are any noticeable trends:

Fundraising Data on all VC Stages in Boston, Trailing Three Months

The good news is that deal volume seems to be holding up this month, despite Massachusetts being essentially locked down. However, I’m curious to know which of the VC deals I’m writing about are “months in the making” versus a hot deal that turned around in a few days or weeks. My guess is the latter is quickly disappearing. In other words, are VCs and founders really moving fast, or are their lawyers just spacing out Form D filings? I think mid-April to May numbers will tell us a lot more about any sort of lag.

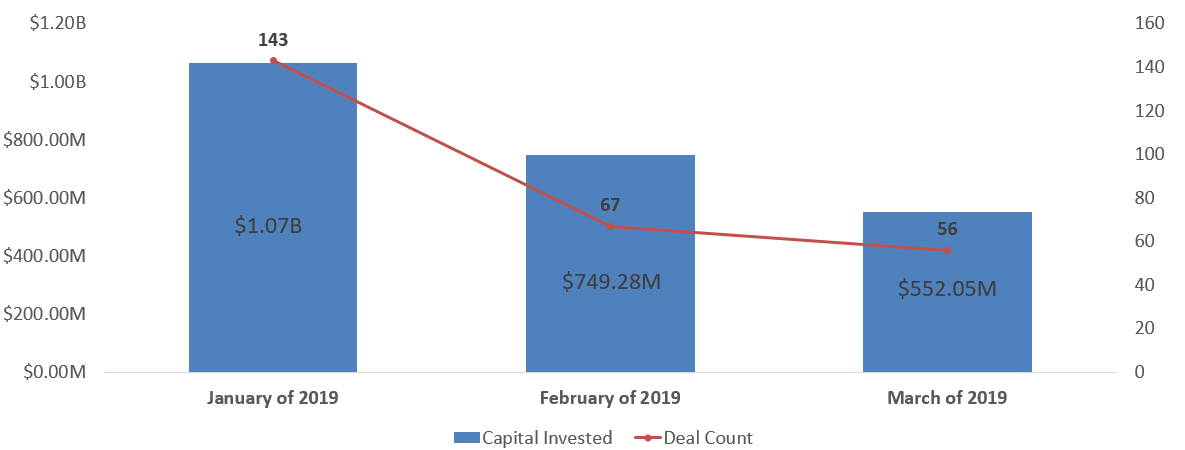

More importantly, zooming out makes things look a lot less bleak. Back in January of 2019, Massachusetts companies only raised about $1.1B in venture capital. But, January 2020 is an unfair comparison for almost any month in Boston’s recent funding history, even surpassing New York in the same time frame by nearly $320M. Similarly, February of 2019 only brought in about $750M for MA-based startups.

The Same Timeframe, One Year Ago

In summary, it’s still too early to tell how the greater Boston fundraising environment is changing in regards to COVID-19 using only fundraising data from completed transactions. The real data is happening right now, in each of your inboxes, as you network with the founders building New England’s next generation of bullet-proof companies.

If you’re new to my emails and posts, welcome! My name is Nick Stuart and I write a weekly newsletter on tech VC financing trends in the Boston area. You can learn more about me on my website here and about the micro-VC I help run here.

VC Financing Deals:

Humanity 👵

Is aging a curable disease? Some scientists are pushing to classify it as so, and it seems like the who’s who of Silicon Valley elites have backed a longevity-focused startup or fund. A funding round this week in Boston made me ponder the question.

Boston-based Humanity is the developer of a mobile app for helping users find out how they can live longer. They just raised $2.38M from so far undisclosed investors. However, some digging on Linkedin shows that Peter Bruce-Clark, Partner at New York-based Social Impact Capital is a backer of the company as of this January. Founded in 2017, Humanity is led by Peter Ward and Michael Geer. Their company is on a mission to create a subscription-based app to help users monitor key biomarkers associated with aging, in an effort to help users positively change them.

I’m unable to tell exactly how the app monitors these biomarkers, but it appears that it then recommends intervention techniques to “Move those biomarkers in a positive direction,” stopping or slowing aging and the onset of diseases. These recommendations may include proactive measures like increasing sleep, taking specific vitamins or other preventative healthcare treatments.

The first thing Humanity made me think of was WeCroak, the app that sends you five push notifications a day, each a reminder that you will die one day. It sounds like a great acquisition target to me!

You can sign up for access to their private alpha at humanity.health.

Coin Metrics ₿

Cryptocurrency market analytics company Coin Metrics just raised a $6M Series A led by Highland Capital Partners, with participation from repeat investors including Castle Island Ventures, Fidelity Investments, Coinbase, and Collaborative Fund. They provide in-depth and vetted data feeds on crypto-asset activity to institutional investors to help them make well-informed investment decisions. The Series A funding brings their total capital raised to just about $8M.

The company was co-founded in 2017 by a current partner at Boston’s Castle Island Ventures, Nic Carter and now CTO Aleksei Nokhrin. They have since brought on several new additions to executive leadership, including CEO Timothy Rice. One notable problem they help solve is the lack of transparency and quality of trading data that you get on websites like Coin Market Cap or CoinGecko. Some traders (and even shady exchanges) engage in wash trading to make a cryptocurrency’s volume appear to be much higher than it is in reality. The company helps bring accurate and reliable metrics to the crypto analytics space by whitelisting qualified exchanges and providing other curated data feeds on trading activity.

LaunchSource🚀

Boston-based sales recruiting startup LaunchSource has raised a $60K tranche of angel funding. The six-year-old firm helps pair budding sales professionals with job opportunities at growing tech companies while providing training resources for job candidates. They call themselves a “career enablement platform and sales education community.” For tech companies, this means offering a hiring marketplace that gives access to a diverse pool of vetted candidates. For young sales professionals, this means offering a platform to help prepare for interviews and browse high-quality job opportunities. Some digging around uncovered that the domain used to be a website for using AI to predict the potential value of an entrepreneurial venture (also a cool idea). Now, it’s led by Sasanka Atapattu, an ex-EIR at the UMass Venture Development Center with a background in MedTech and life sciences.

Everon24 🔋

A Woburn-based stealth energy storage company Everon24 has raised about $3.7M in what looks to be an $8M round of funding. Their SEC filing shows husband and wife Mukesh Chatter and Priti Chatter as directors. The two lead Burlington-based NeoNet Capital LLC. In 1996, Mukesh sold his company Nextabit Networks to Lucent Technologies for $900M. Also listed on the filing is CTO Rahul Mukherjee, an engineering PhD who previously led R&D for a company building graphene-based energy storage systems. According to his Linkedin bio, Everon24 is “Leading research, development and commercialization activities for a novel and inexpensive energy storage technology.”

Further digging led me to a patent application from 2016 held by Rahul Mukherjee and RPI professor Nikhil Koratkar for a “Rechargeable battery using a solution of an aluminum salt as an electrolyte, as well as methods of making the battery and methods of using the battery.” After that first sentence, I pretty much stopped understanding anything.

uConnect 🎓

Cambridge-based college career advancement platform uConnect has raised $870K+ of a planned $1.5M round of funding, per an SEC Form D. Although investors are undisclosed, they’re previously backed by 10x Venture Partners, MassChallenge, TiE Boston, Wasabi Venture Partners, and several individual angels. uConnect helps colleges consolidate all of their career pathway resources into one simplified product. This product can then be integrated into disparate parts of a student journey (from recruiting to graduation) to increase retention and improve overall outcomes. These disparate sources could be academic advising websites, career services pages, and application programs. Existing clients include Bentley, Quinnipiac, Champlain College, and several other universities. The company is led by former financial analyst and Umass Amherst graduate David Kozhuk.

Groupize 🧳

Beverly-based Groupize has closed a third of its $1.5M round of funding, according to a new SEC filing, bringing its total raised to around $11.6M. They’re previously backed by investors like Plug and Play Tech Center, DataPoint Ventures, Tech Coast Anges, Golden Seeds, SideCar, and Launchpad. Founded in 2011, the company has developed a meeting and expense management platform for enterprises. The problem they’re solving is that businesses can struggle to plan the travel, set-up, and management of corporate meetings held in off-campus locations like hotels. Their software is supposed to make the booking experience seamless for small and large companies. Groupize’s President and CEO, Charles De Gaspe Beaubien, also founded a company centered around providing transportation services for groups and meetings.

AeroShield ☀️

Per Crunchbase, Cambridge-based AeroShield received an undisclosed seed investment from Ideaship Fund, an equity-based patent development capital provider out of Oregon. The company develops glass for windows that is “twice as insulating as air and lighter than a marshmallow.” The nanotech for the glass was developed out of MIT using high-clarity silica aerogel. Per BostInno, “The investment will assist AeroShield's mission of supplying insulated glass window manufacturers with its energy-efficient, super-insulating aerogel glass layer.”

Zyprr 🤐

Zyprr, a Boston-based customer success management platform, has raised $1.44M out of a planned $2M angel round. The company’s software offers an all-in-one solution to help enterprises integrate marketing, sales, and other services into one cloud-based product. It was founded in 2014 and went through the inaugural cohort of TiE Boston’s ScaleUp program in 2015. The Zyprr suite of products allows businesses to manage all of their core business processes out of one system to get better visibility into a company’s productivity. They propose that integrating CRM, document collaboration, support tickets, inventory management, and more into one product will provide a higher level of visibility into a company and simplify workflows. They also developed an entire sister website dedicated to real estate software tools called ZipperAgent.

GTxcel 📰

Southborough-based publishing platform GTxcel has raised a $6.98M round of later-stage equity and debt financing, per an SEC filing. They’re backed by Square 1 Bank (PacWest) and New Science Ventures. Their Turnstyle product renders static documents into responsive text that can be integrated across a company’s entire brand. This helps paper-based publishers easily convert their content into a digital experience to expand customer reach. The company has now raised about $36M of outside capital.

Thanks for reading!

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.