VC During Economic Uncertainty

On Wednesday, USV’s Fred Wilson wrote five reasons why he wouldn’t be surprised if the fundraising data coming out of Q2 2020 shows strong resilience against the pandemic. His reasoning:

VCs are paid to invest. There’s no shortage of good investments.

A bullish equities market = a bullish venture capital market.

The types of companies VCs invest in are proving to be pandemic resistant.

VCs can’t waste time golfing because everything is closed = more investing.

If anything, the pandemic has increased the number of new great founders.

(Context: Pre-COVID Q1 2020 was the second-best quarter for US VC in history)

Anecdotally, I’ve heard a lot of investors agree that they are in fact “open for business” even more than before the COVID-19 outbreak. However, a new report from Pitchbook tells a more cautionary tale than Fred’s and others. They pulled fundraising and exit data from the 2008 global financial crisis to draw comparisons and make projections about how the impending recession might impact the fundraising landscape.

Below are some of the key takeaways I found interesting regarding seed, angel, and early-stage investment:

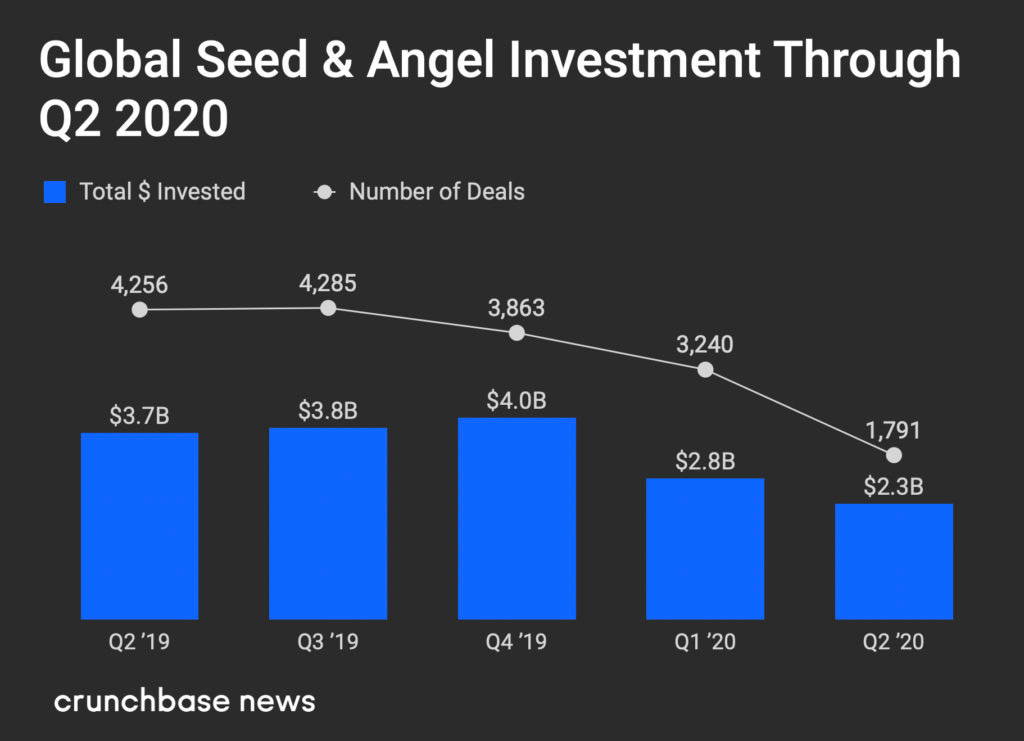

1. Expect Angel/Seed Deals Today to Fall Like Early-Stage Did in ‘08

During the global financial crisis, angel & seed deals weren’t as prominent as they are now. Today’s angel & seed deals more closely resemble what early-stage deals looked like a decade ago. Considering deal count shrunk 33% and capital investment shrunk 45% for early-stage deals during the last crisis, Pitchbook is betting on that happening again for angel & seed deals this time around.

Related: The most current H1 Seed & Angel data from Crunchbase:

2. Depressed Valuations May Further Push Startups to Debt

The “step-ups” in valuations among early-stage startups will likely get smaller. From 2008 to 2009, the average valuation increase from a funding round dropped from 1.6x to 1.1x. Going forward, we might expect an up-round to yield a startup a 110% higher valuation, but not 150%+.

This is of course unfavorable to startup founders. To mitigate the potential of receiving unfavorable deal terms or unnecessary dilution, many firms may seek debt financing when they would normally be seeking equity. This might look like traditional venture debt or other new forms of non-dilutive, revenue-based financing like Clearbanc or Pipe. This trend isn’t new by any means. Venture debt has been soaring in popularity for several years.

For more context on why this wave of venture debt might be different, I’d recommend John Luttig’s When Tailwinds Vanish and Alex Danco’s Debt is Coming. They both touch upon the impending securitization of ARR that software companies will utilize to avoid equity financing — and why it might be good.

3. Uncertainty Means CVCs May Put the Brakes on New Investments

The rise of non-traditional investors, namely corporate venture capital, has been sharp in the last few years. Pitchbook says we should expect their pullback in investment to be just as sharp. After the ‘08 crisis, nontraditional investor participation dropped by 33%. The difference this time around is that nontraditional investor participation as a percentage of total VC investment has grown from 21% in 2009 to 66% in 2019. See also: DLA Piper CVC Investment Strategies in the COVID-19 Pandemic.

It’s of course important to remember that many of these figures are lagging indicators, especially at the earliest stage where deal reporting can get hazy. I’m curious what my readers are seeing out in the wild.

Shoot me an email if you have any thoughts.

Stuff I’m Reading:

One of the coolest strategies I’ve seen for getting in front of VCs

Designing humility and forgiveness into social media products — Nick Punt

TikTok competitors in India see 22M+ growth in DAU’s in 48 hours.

VC Financing Deals:

Notarize ✍️

Boston’s Notarize has closed a $35M Series C led by Polaris Partners (where Notarize’s CEO is also a Venture Partner), with participation from Camber Creek. Notarize saw accelerated growth fueled by the pandemic, experiencing a reported 400% growth in the last 90 days. The company has built a platform for 24/7 online access to notaries for signing legal documents.

Meanwhile, DocuSign acquired online notarization company Liveoak Technologies last week for $38M. Notarize has now raised over $83M, about six times what Liveoak raised before the acquisition.

Jobcase 💼

Lot’s of interesting occupation-based social networks popping up in Massachusetts. In the past few weeks, I’ve covered that Hard Workers and TradeHounds have raised capital. Last week, Cambridge-based Jobcase received $30M from Providence Strategic Growth and Workday Ventures. The company is has built something very similar to Facebook, but centered around employment topics. It also has a job board and resource collection for helping people get employed. At eleven years old, Jobcase has now raised over $178M, according to Crunchbase.

Cazena 💽

Waltham-based Cazena received investment from Underscore VC, a notably later-stage deal for the Boston-based VC. The investment comes at the heels of Cazena’s launch of it’s Instant Cloud Data Lake service and hiring of chief revenue officer Chad Garrett. Data Lakes are essentially centralized places where enterprises can easily store all sorts of structured and unstructured data for various analytics, digital transformation, and AI/ML purposes. Founded in 2014, they previously raised $38M from a16z, North Bridge Venture Partners, and Formation 8.

Righthand Robotics 🦾

Righthand Robotics is in the process of raising $8M in debt, with $6M of which already closed, according to a Form D. The Somerville-based e-commerce fulfillment robotics company has previously raised over $34M from investors including GV, Menlo Ventures, Matrix Partners, and Playground Global. They’ve developed RightPick, a robotic arm capable of automating e-commerce order fulfillment tasks.

Heila ☀️

GreenTech company Heila Technologies is in the process of raising $3M in equity, with $2.1M of which already closed. The three-year-old company is building a platform to help customers grow self-managed solar microgrids. They’re doing so by developing a computing device that automatically optimizes the distribution of resources on a microgrid.

Volos 💸

Boston-based Volos, a six-year-old developer of software for analyzing options trading strategies, just raised $1.3M according to Crunchbase. The company is led by Dan Corcoran and has 11 employees according to Linkedin. They build custom software to help institutional investors implement options trading strategies into their portfolios.

Tour24 🏘️

Tour24, a mobile application that lets property managers set up self-guided tours, is raising $3M in debt according to a Form D. The Medfield-based company integrates with keyless access entry systems used in modern buildings and uses audio and visual cues to help prospective renters tour a facility solo. Seems like a no brainer for property owners/managers looking to free up time. The company is founded and run by Georgianna Oliver and boasts seven other employees, according to Linkedin. Their website claims the app is active in 70 locations.

Thanks for reading!

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.