The Angel Market & COVID

The University of New Hampshire's Center for Venture Research released a new report detailing COVID-19’s current and potential impact on the angel investing market. Long ago, UNH actually coined the term “Angel Investor” as it relates to venture finance, and the university’s Center for Venture Research is considered to be an authority on early-stage investment research. I know this because I was lucky enough to work under the Center’s Director, Jeff Sohl, during my undergrad through the Rines Angel Fund. He’s commonly referenced at places like CNBC, Boston Business Journal, The Information, the White House, and more.

Why is his team studying COVID’s impact on the angel market? Because, as Jeff puts it, “Any potential decline of the foundational, and critical, seed and start-up financing provided by angel investors could lead to significant, and lasting, repercussions throughout the risk capital ecosystem.” I read through the report to get a better idea of what he’s seeing from the data. Here’s a brief overview":

1. The COVID Impact was Swift in the Market

Using survey and Pitchbook data, they compared YoY changes Q1 deal count and capital invested from 2018-2019 to 2019-2020. They note that Q1 normally sees a decline in deal count and capital invested. They attribute this to a mixture of “holiday hiatuses” and HNW individuals re-assessing their portfolio allocation into high-risk venture deals before starting the year. As someone who tracked deal flow for an angel group for two years, this is also something I noticed.

“Since angel investors are high net worth individuals, given the correction in the public equity markets the angels’ net worth will likely have declined and so will the pool of capital they deploy for angel investments. Thus, it is expected that total dollars invested in 2020 will decline. However, if past events offer any guide, the total number of investments will hold steady.”

With that said, the dip in deal count from 2019-2020 is significantly more pronounced than 2018-2019’s by a factor of four. For capital invested, the data is almost inverted when comparing 2018-2019 and 2019-2020, with a net change of -58%!

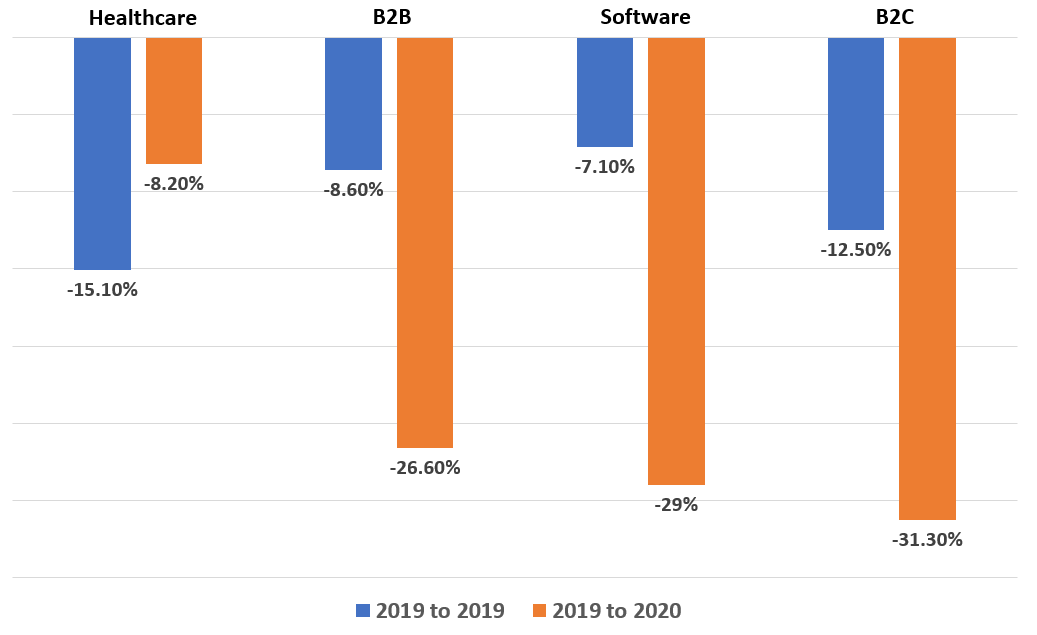

2. Angels Are Shifting Industry Focus in the Wake of COVID

Long story short, every sector saw a decline in absolute deal activity. Unsurprisingly, investment in consumer companies declined most sharply according to the research. Even more unsurprisingly, angel investments into healthcare companies saw the smallest decline.

“These preliminary data indicate that healthcare could be poised to be the dominant sector for angels, but it is worth noting that software investing is fluid and has widespread applications.”

3. High Yield Rates are a Cause for Concern

A fascinating metric that is tracked by the CVR is the “angel yield rate.” It’s defined as “the percentage of investment opportunities that are brought to the attention of angel investors that result in an investment.” I believe it implies a certain sense of vetting has been done beyond a cold email to investors and is tracking startups that were at least seriously considered for investment. In 2019, that yield rate was 30.7%, compared to only 17.2% in 2018. Angels were getting a lot less picky leading up to COVID.

Sohl’s research notes that “While a high yield rate is encouraging for entrepreneurs, historically yield rates above 25% have not been sustainable over the longer term.” I think that makes sense and I’m surprised that 3 in 10 deals brought to the attention of angels resulted in an investment. That seems incredibly high. The research also notes that as yield rates climb, so does competition, which tends to result in inflated valuations at the earliest-stages of priced rounds.

Looking back at previous recessions, they claim, “yield rates declined to 10% in 2008 and 14.5% in 2009. Certainly, the causes of the post-2000 decline and the 2008/2009 recession were different than today’s pandemic induced downturn, but the impacts could be similar.”

4. You Have to Play the Long Game to be an Angel

Even when short term data points to grim outcomes, it’s important to remember that being an angel is a long-term, highly illiquid investing strategy. The exit horizon for most angel deals is long enough that all angels shouldn’t just brace for a recession, but assume that at least one will occur before their company exits. Obviously this pandemic spooked a lot of angels in the short term, but it really doesn’t mean much for angels and VCs in the long term.

“The most pressing issue, from a market perspective, will be decisions on where to allocate the angels’ diminished investment capital. Angels will prioritize and bridge their existing portfolio companies, and if this reallocation of risk capital is substantial it will be at the expense of the seed and start-up stage market.”

Stuff I’m Reading:

VC Financing Deals:

LearnLux 🤑

Some quick math shows the difference between contributing to your retirement at age 25 versus 35 is massive. It’s just one of the many important lessons of financial literacy that you probably didn’t learn in high school. Not understanding concepts like employment benefits, retirement planning, and insurance during your early years can be financially damaging later down the line. Rebecca and Michael Liebman noticed this and saw an opportunity to help employees make better financial decisions when it matters most. They founded financial wellness startup LearnLux, which is currently raising $6.2M.

LearnLux is an education hub that offers a collection of interactive financial wellness tools for budgeting income, paired with some one-on-one guidance from LearnLux advisors. It’s offered as a SaaS subscription and can be tailored to the needs of specific companies so HR leaders can better understand how employees are grasping various financial wellness concepts. They’ve previously raised ~$3M from Marc Benioff, Ashton Kutcher’s Fund, Underscore VC, and a handful of other investors and accelerators.

Tinyhood 👶

Sometimes when I regrettably open Facebook, I’m reminded of the many people I know who are somehow legally parents. Seriously, we need to get a license to drive a car…Shouldn’t there be some sort of qualification for creating a sentient life form? The next best thing is Tinyhood, a three-year-old startup providing personalized parenting courses and is currently raising $2M.

The company is like Masterclass for raising infants, covering everything from breastfeeding and sleep tricks to CPR and discipline techniques. The courses are anywhere from $15 to $40 apiece, and all breastfeeding courses are currently free for parents during the COVID outbreak. They also offer a closed community to parents and one-on-one consultations. The founders have previously been through the female-focused accelerator MergeLane and have received ~$5M in capital from Pactolus Ventures and Trail Mix Ventures.

Tru 🧉

The Boston area has a lot of neat beverage startups. On this blog, I’ve covered NOCA, Ohza, Spindrift, Loco Coffee, and Willie’s Superbrew. Last week, Tru entered the scene with $1.7M in funding. Founded by ex-pro hockey player Jack McNamara, the Chestnut Hill-based company makes energy shots for athletes that are infused with caffeine, electrolytes, and vitamins. It looks like they’re backed in part by Crocker Mountain Capital, as Michael Inwald is listed on the Form D. They also have Danone’s President of Coffee Creamers & Beverages on their board.

Orbita 🔊

The other week, I wrote about a company called LifePod that uses smart speakers to help caregivers communicate with patients. Last week, a similar conversational AI software company called Orbita began raising $8.5M. Founded in 2015, Orbita is a full-service virtual assistant for the healthcare industry that’s previously backed by HealthX Ventures, Newark Venture Partners, Cultivation Capital, and MassChallenge. They provide Drift-style conversational AI that can engaged with via typing or through audio on smartphones or smart speakers.

E25Bio 🦟

E25Bio, a startup specializing in the early detection of viruses, has raised $2M. They create paper-based rapid testing products that can take as little as five minutes. According to their bio on The Engine, they started the company to quickly identify mosquito-borne illnesses in the Amazon rainforest and have since pivoted tackling the coronavirus.

Amwell 🖥️

Telehealth company Amwell has bagged $194M to keep up with the increasingly growing usage of its services. The 14-year-old company provides a wide variety of telehealth services for patients and providers. According to Business Insider, Amwell had raised $500M prior to this Series C funding round.

Clean Crop Technologies 🌿

Clean Crop Technologies, a two-year-old startup focused on advanced fumigation, is raising $3M. The company has previously been backed by MassChallenge and Lever. Clean Crop is developing a fumigation technology that combines air and electricity to create an ionized gas that removes food toxins, mold, and pests from food while extending its shelf life. It’s founded by a team of agricultural specialists based out of Haydenville, MA.

RailPod 🚆

RailPod, a 13-year-old railroad analytics company, is raising $11.4M. The Greentown Labs and MassChallenge alumnus has developed a hardware system for inspecting the 140,000 miles of rail infrastructure in the US. It’s founded by Brendan English, who spent 15 years using AI to optimize safety at the US DOT.

NBD Nanotechnologies 💧

NBD Nano, an eight-year-old company that develops liquid repellants for a variety of surfaces, is raising $2.25M. This follows its 2017 Series B led by BASF VC, with participation from Phoenix Venture Partners, Henkel Ventures, and Better Ventures. They create coatings, additives, and adhesives that help products last longer and look nicer in rough environments.

Thanks for reading!

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.