Welcome Back!

I’ve spent this quarantine weekend digging through a list of Wikipedia rabbit holes from Reddit. I think the craziest one has to be the history of Unethical human experimentation in the United States. Did you know that the US military airdropped 300,000 mosquitos over the state of Georgia in 1955, code-named Operation Big Buzz? I should really get outside more.

Also, FinTech Founders Wanted:

The DCU FinTech Innovation Center is taking applicants for its Summer 2020 cohort. It’s a completely free and non-profit program focused on fostering FinTech for good by supporting pre-revenue/pre-PMF FinTech startups with under five employees and less than $1M raised. They give away over $250K in perks for no fees or equity. Applications close May 1st.

Stuff I’m Reading:

The State of VC, in Graphs

Last week, the NVCA put out its quarterly Venture Monitor Report, PwC put out its Money Tree US VC Report, and Crunchbase published its Q1 Global VC Report, each highlighting important developments across the venture ecosystem. Each of their numbers differ slightly, but the verdict is that MA companies raised ~$4B across about ~200 deals. I collected some graphs from each report that may be of interest to early-stage investors and entrepreneurs.

Total US Deals and Dollars Invested — Zooming Out

We’ve seen the slowest output of deal activity for Q1 since 2013. However, the actual capital invested this quarter was still higher than Q1 of 2014 through Q1 of 2018.

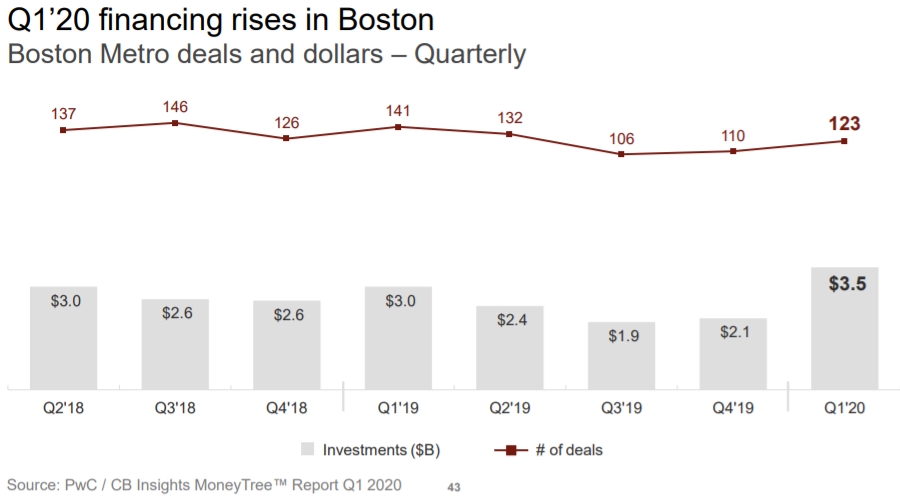

Boston Financing Trends

What a weird start and end to the quarter. If you traveled back in time and handed this graph to a New England investor, I wonder what they’d think the economy looks like right now. As covered by Bostinno, the bulk of this jump in capital invested comes from the 10+ megadeals from the quarter like Toast, Berkshire Grey, EQRx, and Indigo AG.

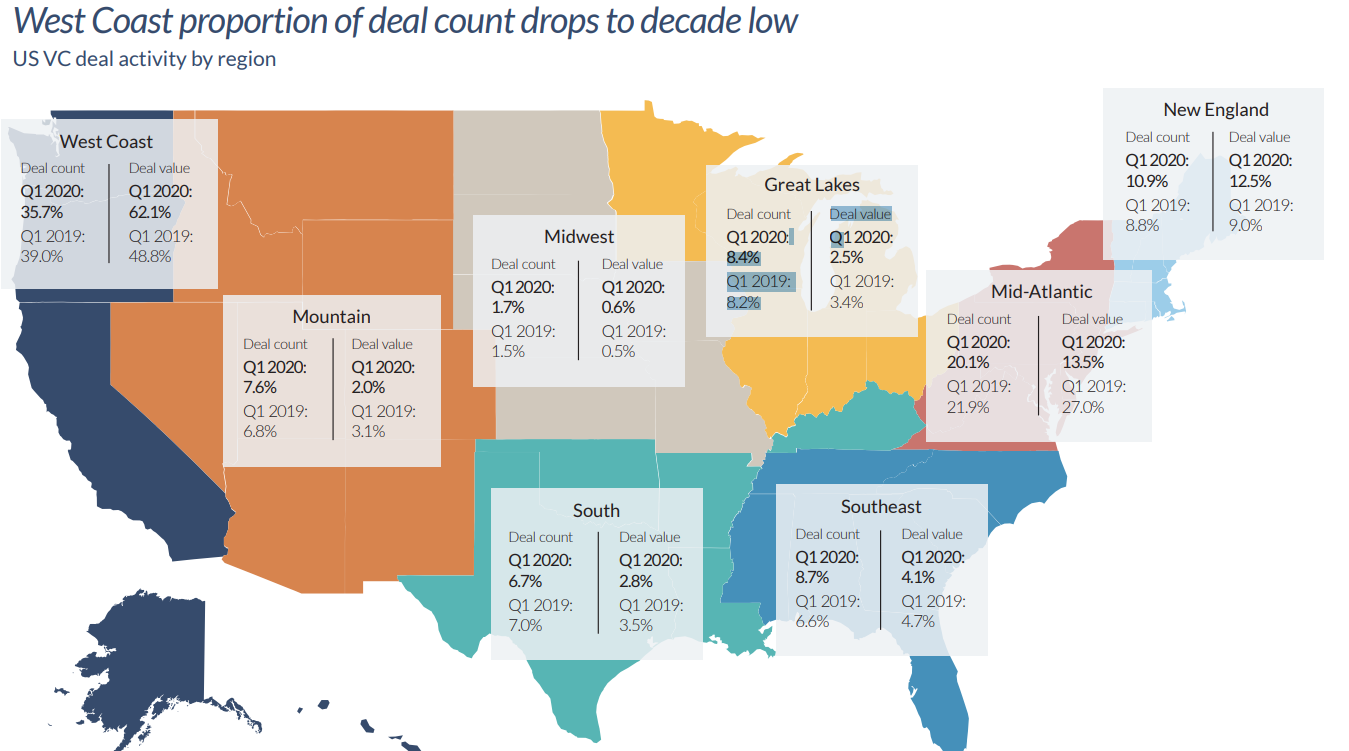

A Geographical Perspective

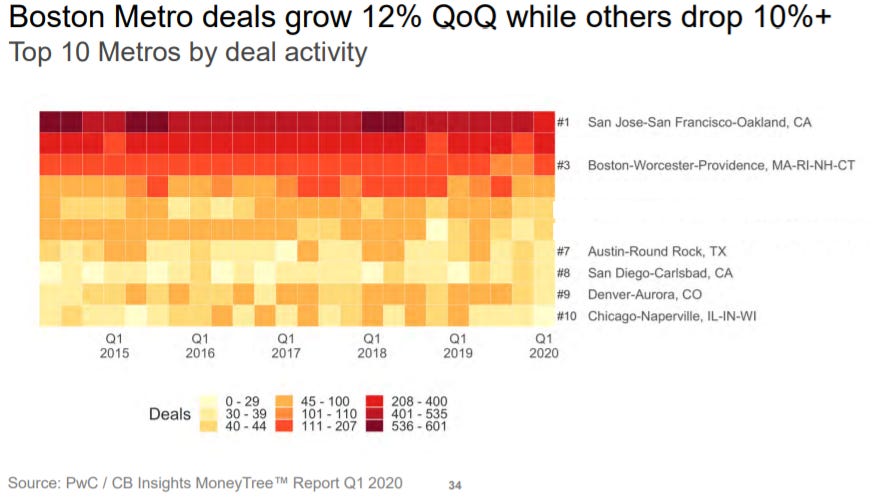

According to PwC, Boston Metro ranked #2 in terms of growth in capital invested and #3 in growth by deal count.

For New England as a whole, we made up 12.5% of total deal value and 10.6% of the total deal count in the US. A year ago at this same time, New England VC took up 9.8% of national deal count and 10.2% of national deal value.

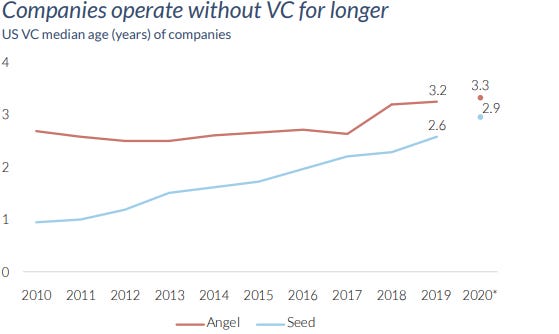

Startups Are Growing Up Before Raising

This graph is calculated in Pitchbook by taking the median number of years from “Date Founded” minus “Date of First Financing” to get an idea of how long companies are going without institutional money. I have a hunch that if the median employee count was overlayed on this graph, it would show that teams are remaining smaller for longer as well.

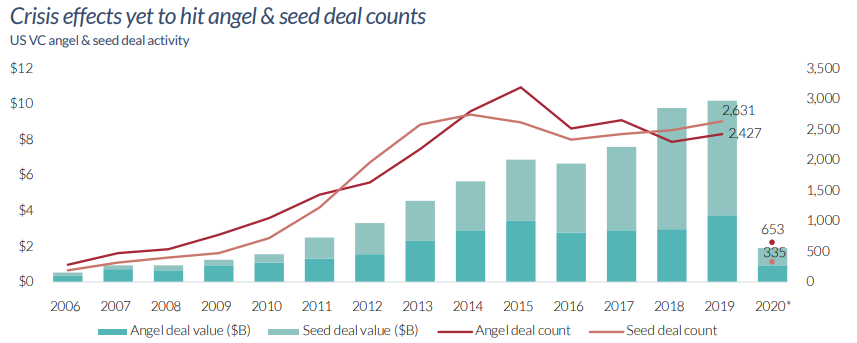

Angel & Seed Deals

Technically, the US still on pace to match the 2019 angel & seed financing numbers. According to the Venture Monitor Report, valuations for these deals are relatively flat as well, with a median pre-money valuation of $7.5M at the angel stage and $7.8M at the seed stage.

Gender Trends

In terms of allocating capital toward all female-founded teams, New York is doing quite well when adjusted for the size of its ecosystem capital-wise. Boston isn’t too bad either, with 302 VCs allocating $1.73B into all-female teams between 2006 and Q1 of 2020. However, all female-founded teams in the US still only made up about 1/20th of total US VC deals this quarter, and teams with at least one female founder accounted for about 1/5th.

New Institutional Money

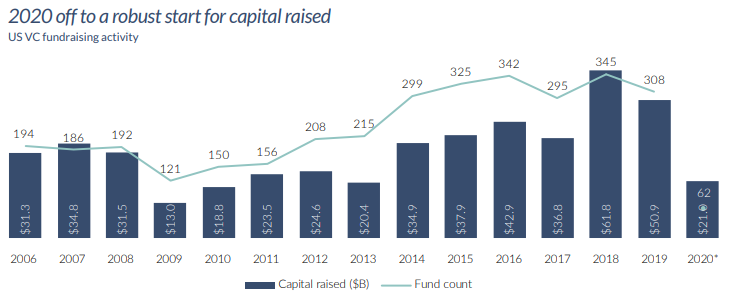

Last week, I shared an article about the potential of VCs running out of dry powder. The author, Jon Sakoda, assumed that $150B in dry powder exists. The CEO of Pitchbook referenced a figure closer to $121B in this report. As a counter-argument to that article, well-established VCs have already raised almost half of 2019’s total fundraising numbers:

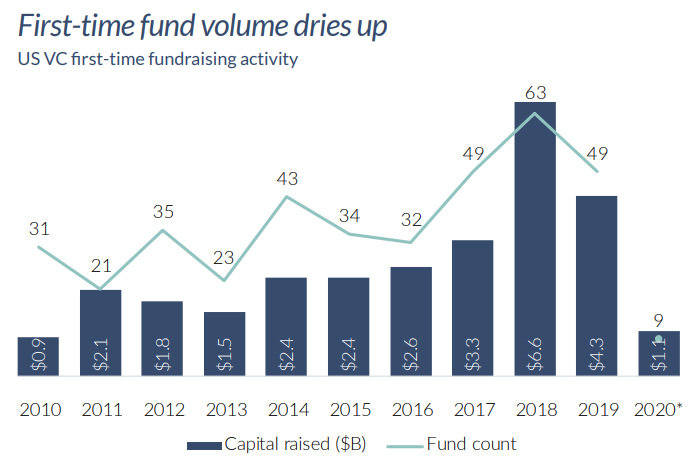

I say “well-established” because newcomers are being cut off from the frenzy:

Relevant Read: Mega-funds thrive despite hard times for small and first-time VCs

Anyways, I thought these were some interesting graphics and always enjoy hearing the perspective of analysts at each respective publisher. If you want some further perspective, check out some of the discussion points in the Venture Monitor Q1 2019 report. WeWork hadn’t even imploded yet, Lyft had just IPO’d, people still shook hands…what a time. Let’s get on to deals that happened locally this week:

VC Financing Deals:

Kebotix 🤖

Back in 2017, MIT News published a piece called, Artificial Intelligence Aids Materials Fabrication. The article outlined the potential of using AI to analyze millions of scientific papers to model the development of new materials.

“The researchers envision a database that contains materials recipes extracted from millions of papers. Scientists and engineers could enter the name of a target material and any other criteria — precursor materials, reaction conditions, fabrication processes — and pull up suggested recipes.”

In a world where we can simulate millions of experiments simultaneously in a computer, there’s still one bottleneck: actually doing it. A three-year-old startup working out of The Engine called Kebotix is trying to bridge the gap between theoretical material development and physical labor. The company just raised $11.5M led by Novo Holdings.

Kebotix has created a “self-driving lab” that uses AI to formulate new potential materials and autonomous robotic arms to test the development of those materials in the real world. As the system tests experiments in a lab, it can self improve based on recorded outcomes — without human intervention. Right now, they focus on developing molecules for use in electronic systems. However, imagine a future where you can tell a robot about any molecule you want and it works 24/7 to figure out the best formula for developing it. Kebtoix is previously backed by One Way Ventures, Baidu Ventures, Embark Ventures, Flybridge Capital, Propagator Ventures, and Worldquant Ventures.

Notarize ✍️

After adding 1,000 new notaries to catch up with demand following the shift to WFH, Boston-based Notarize has now raised $25M out of what looks like a $38M Series C. No formal announcement on investors yet, but they’re previously backed by notable firms like Founders Fund, Polaris Partners (where the CEO is a venture partner), Ludlow Ventures, and Tiny Capital. Founded in 2015 by Patrick Kinsel, Notarize chose an extremely self-explanatory startup name. They help businesses virtually connect with licensed notaries 24/7 to speed up the notarization process of buying homes, executing wills, or officiating other transactions.

Blackburn Energy 🚚

A six-year-old CleanTech trucking company called BlackBurn Energy just raised $2.1M, per a Form D filing. The company develops hardware that improves the fuel economy of diesel trucks while reducing emissions and providing a telematics system.

Their main product is a kinetic energy recovery system that can be retrofitted onto existing trucks. By storing kinetic energy from braking and downhill coasting, drivers can generate electricity, store it in an auxiliary battery, and use it for the many electronic components on a modern truck (lifts, radios, etc). This takes stress off of the alternators and allows truck drivers to use those electronics without idling the vehicle.

They claim this allows trucks to produce 5x more electricity than possible with alternators alone. They’ve gone through TiE Boston, MassChallenge, and Cleantech Open Northeast. Previous backers include Village Capital, Wasabi Ventures, and Mass CEC.

Image: Screenshot of a Blackburn Energy power generator component.

meQuilibrium 🛡️

HR-Tech platform meQuilibrium is currently raising $5M, which will bring their total raised to ~$45M. The company has created a suite of products that use a scientific approach to improve the cognitive performance of companies and the resilience of employees. Using their meQ Engage, meQ Empower, and meQ Collaborate products, they assess one’s strengths/weaknesses and create a personalized activity journey to improve job performance in a measurable way. It kind of sounds like if Wendy Rhoades became a software product.

Alivia Analytics 🔍

AI-driven healthcare payments analytics company Alivia Analytics has raised $250K according to a Form D. Although this is its first recorded venture funding, the company is 11 years old according to Pitchbook. Led by Kleber Gallardo, Alivia’s Absolute Insight product uses predictive AI to discover fraud and waste in payment systems used by Medicaid insurers, private insurers, and 3rd party claim administrators.

Medically Home 🏥

Medically Home, a four-year-old telehealth company focused on serving high-acuity patients from their homes, just raised $10M in a convertible note. This follows a $23M Series B that closed just four months ago. The Connecticut and Boston-based company is previously backed by Cardinal Health, Huron Consulting Group, and Connecticut Innovations.

Thanks for reading!

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.