An interesting Medium post was published by a Boston-based CEO called Choosing Success last week. She’s the CEO of a high-growth, YC-backed fintech startup called Catch that’s building a benefits safety net for the gig economy. The article outlines her reasons for leaving the Boston startup ecosystem. They were mainly:

High cost of living and salary expectations

Cynical and unfriendly tech environment

Conservative and traditionalist VCs

Misaligned/gatekeeper startup organizations

Lack of peer startups by industry/age

“Not a city that will enable a $100B outcome”

Relocation is extremely company-dependent, and she made a calculated call based on her experience that NYC would best serve her company — nothing but respect there. Even if I would personally challenge a few of her points, it’s worth trying to understand why a promising tech startup CEO publicly dunked on Boston as a viable startup hub. What could be learned here?

Her last point on Boston not enabling $100B+ outcomes for startups was particularly interesting to me when thinking about tech migrations more broadly. First, because Boston does have some amazing exit outcomes (and they’re very on par with NYC) — but second because the last 12 months have shown that founders, investors, and tech workers aren’t (and probably never were) relocating based on historical exit results. Setting aside NYC, (people are leaving there just as fast as they’re leaving Boston) I think founders are flocking to this general *$100B+ outcome mindset*. It’s not any one place, and it’s less bound to the pessimism of reality that historical exit figures can give you. If you add on low costs of living and new local dry powder, is that the key to attracting talented new companies?

New tech hubs are growing with ~vibes~ while old tech hubs signal with numbers

Miami is literally being memed into existence, while other hubs like Atlanta, Philadelphia, Utah, and Texas are growing faster than ever. I’m actually scared for people to realize how great New Hampshire is before I get a chance to buy a house there. One advantage that newer hubs have against the old guard (SF, NYC, Boston, LA) is a lack of precedent. They’re not playing numbers games, they’re forming a new set of entrepreneurial DNA. I mean, their mayors are literally startup hype beasts.

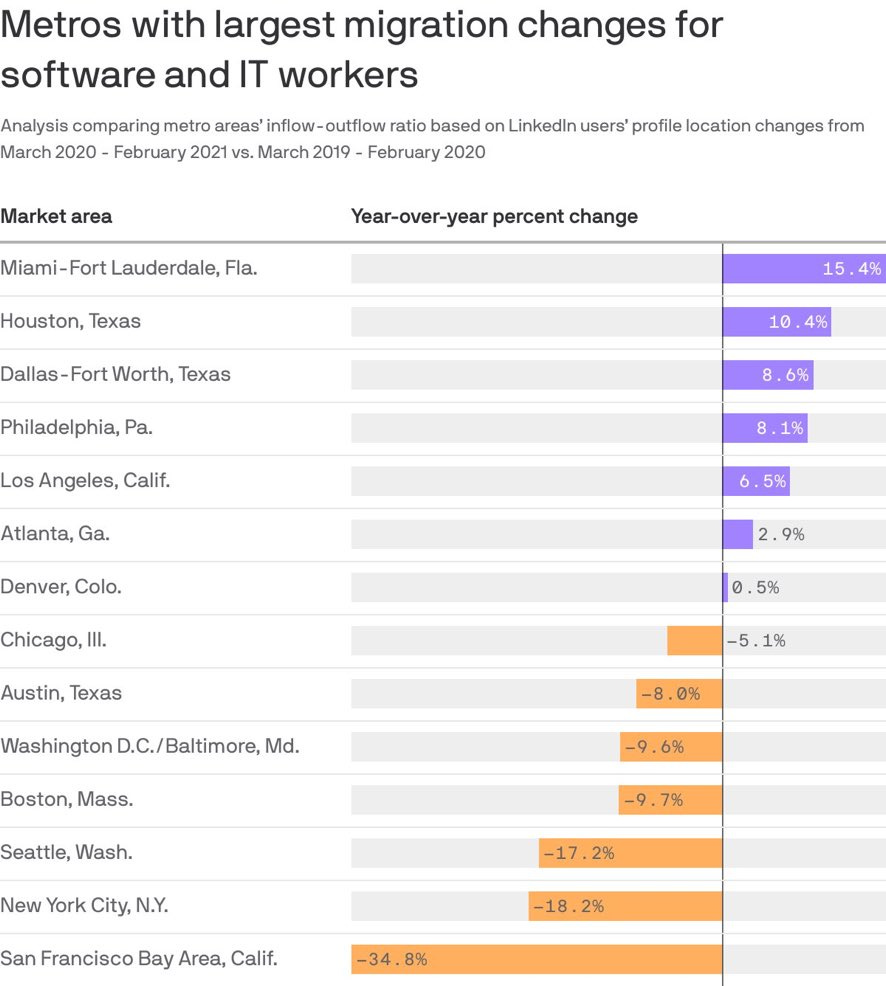

It’s kind of like how a pre-revenue company often gets valued much higher than one with a small amount of revenue. Pre-revenue companies are all about the vibes, man. Having numbers tethered to reality can discount your future potential. The same could be said about “pre-breakout” tech hubs that might lack a presence on the NASDAQ or a big-ticket M&A but are growing rapidly. I doubt anyone that’s migrating to these hubs, or championing them, is saying, “You’ll be a $100B company here, guaranteed.” They’re saying something like, “Come here and make this place everything you’ve ever dreamed for your startup. We’re rooting for you!” Whatever they’re saying, tech workers seem to be listening:

I don’t have any big answers here, just jotting down some thoughts. But aside from pointing to our successful tech outcomes (of which there are many), what can Boston tell founders to let them know, “We’re rooting for you, whatever the outcome”? I’m not saying that it makes sense to cater to the companies that left the city because they didn’t see a future here, but how can we cater to those looking for a place that sees a future in them?

Stuff I’m Reading:

The Future is DAO: A primer on DAOs and their explosive growth

Instead of crowdfunding startups, VCs are crowdfunding themselves

BTC is coming to hundreds of U.S. banks this year, says NYDIG

Boston Tech Financings:

Lightmatter 💡

In March I shared an article on Lightmatter, a company that’s building chips that work using light instead of electrons. Last week, they announced an $80M Series B led by Viking Global, with participation from GV, Matrix Partners, Spark Capital, and others. The MIT-spinout is developing light-based chips that they believe will outperform traditional chips used in AI research and applications.

Groups Recover Together 💊

Groups Recover Together, which is developing a platform to tackle opioid addiction by giving addicts access to Suboxone, counselor meetings, and other treatment, has raised a $60M Series C. The round was led by Oak HC/FT, with participation from Bessemer, Transformation Capital, RRE Ventures, Optum Ventures and Kaiser Permanente Ventures.

Zoe 💩

London and Boston-based Zoe just raised a $53M Series B led by Ahren Innovation Capital, with participation from Accomplice, Eli Manning, and others. The four-year-old company delivers a range home nutritional testing kits to give customers deep insights into how they process food. This includes glucose monitoring, poop tests, metabolism tests, and blood fat tests.

Crayon 🖍️

Competitive intelligence startup Crayon has secured $22M in Series B funding led by Baird Capital, with participation from Baseline Ventures, Bedrock Capital, C&B Capital, and Oyster Funds. Their software lets companies track the digital footprint of any competitor across hundreds of sources to see what kinds of changes they’re implementing.

Capchase 💸

A new filing shows New York and Boston-based Capchase has raised $29M in new funding on the heels of announcing a $100M funding initiative to support women and minority led businesses with non-dilutive capital. I’m fascinated by this company and space and have written about it in the past. They let companies with monthly recurring revenue receive an annual lump sum upfront, for a fee.

Pliant ⚡

Low-code IT process automation platform Pliant just announced a $10M Series A led by Osage Venture Partners. The four-year-old company helps organizations build workflows that eliminate manually driven IT infrastructure activities. They aggregate blocks of code from publicly available APIs from vendors to make it easy for companies to spin up workflow automations that save them time. I last wrote about them in Aug’20 when they raised $1.4M.

Upshot ⁉️

Blockchain “Q&A protocol” Upshot just raised $7.5M in Series A funding led by Framework Ventures, Coinfund, and Blockchain Capital. They want to create a protocol that incentivizes experts to give honest answers to questions. They’re starting with NFT appraisals, betting that consistent, real-time price discovery for NFTs will make them a more valuable asset class.

Datanomix (New Hampshire) 🏭

Datonomix, a NH-based factory floor machine intelligence company, just raised a $6M Series A from Gutbrain Ventures, PBJ Capital, and CEAS Investments. By attaching sensors to machines on the factory floor, Datanomix provides real-time production monitoring and condition detection to shop managers.

Neuroeletrics 🧠

Personalized neuromodulation company Neuroelectrics just raised a $17.5M Series A led by Morningside Ventures. The Barcelona and Cambridge-based company is using custom hardware and software to develop a new type of brain therapy in the field of transcranial electrical stimulation. They’re still in clinical trials, but early results are showing massive reductions in seizure frequencies among patients in a pilot study.

Montony.ai 🤫

Three-year-old stealth mode company Monotony.ai just raised $17.5M, according to a new filing. It’s run by Ben Bixby, who ran a utility monitoring company called MyEnergy before it was acquired by Nest, where he remained a GM for several years. The Form D also lists Austin McChord of Outsiders Fund and Craig Shapiro of Collaborative Fund. They have previously raised some seed money from SF-based Incite Ventures as well.

Coin Metrics ₿

Crypto data analytics firm Coin Metrics just secured a $15M Series B led by Goldman Sachs, with additional new investment from Acrew Ventures, Morningside Group, BlockFi, and Warburg Serres. They’re a full-service crypto data provider that focuses on selling to institutions, hence why backing from an institution like Goldman is some big time validation. This also included follow-on from Castle Island Ventures (who’s partner was a Coin Metrics cofounder and current chairman), Highland Capital, Fidelity, Avon Ventures, and others.

Jock MKT 🏅

A new filing shows that Jock MKT just raised $10.1M to build a cash-based stock market for fantasy sports. It’s run by Tyler Carlin, and will be going up against existing large players like DraftKings as well as other newcomers like Wagr.

Tertill 🐢

Autonomous lawnmower company Tertill just raised $3.9M in a $4.5M round, according to a new filing. Led by iRobot’s founder, they’ve been on the scene for quite some time now — previously raising a mix of venture and crowdfunding money. According to Boston Business Journal, the round included participation from Garage VC, Moai Capital, Regah Ventures, R42 Group, and MIT Angels.

Emvolon 🔥

Emvolon, which converts old diesel engines into chemical reactors, just raised a $1.5M seed round led by The Engine. They want to take the hydrocarbon-rich and highly pollutive flare gas emitted from natural gas plants and convert it on-site into chemicals such as methanol.

Nix 😅

Biosensor company Nix has raised $800K in a $2.5M round, according to a new Form D. Led by Meridith Cass, they’re working on a single-use wearable that uses photonics to detect dehydration levels based on biomarkers present in sweat. It’s a similar business model and form factor to Levels — which focuses on glucose monitoring for athletes. They’ve raised in the past from MassChallenge (2015), Stadia Ventures, Techstars (2017), Tillman Venture Partners, and several other investors.

I’m getting really excited about the quality of biosensor breakthroughs happening in recent years. Boston alone is working on world-leading technology to track resting heart rate, HRV, respiratory rate, Blood Oxygen, blood pressure, and more — and Apple might just be working on photonics-based alcohol and glucose monitoring for the Apple Watch. It feels like we’re inching closer to a day when every major biomarker can be monitored 24/7 on our wrist with clinical-level accuracy.

Canvas🖌️

A new filing shows that technical illustration software company Canvas raised $340K, following a $3M Series A last April. Canvas is like Figma, but for highly-detailed visual assets like airplane engines instead of iPhone apps. They develop a suite of SaaS products for sharing complex design information in a collaborative way across an entire product lifecycle. Making the technical design process easy to manipulate can shorten product development times so their customers in aerospace, defense, and manufacturing can ship products quicker.

Megabite 😋

Another Form D shows that Megabite has raised $175K in a $750K offering. It’s a platform for food and drink recipe discovery that lets you share in a TikTok-style format.

Thanks for the well-written article. I believe it would be helpful for you to plan your writing ahead: https://bordio.com/