Boston Robotics Breakthroughs Hiding in Plain Sight

And Six Boston Tech Companies That Raised Last Week

Boston Robotics Report 2020 🤖

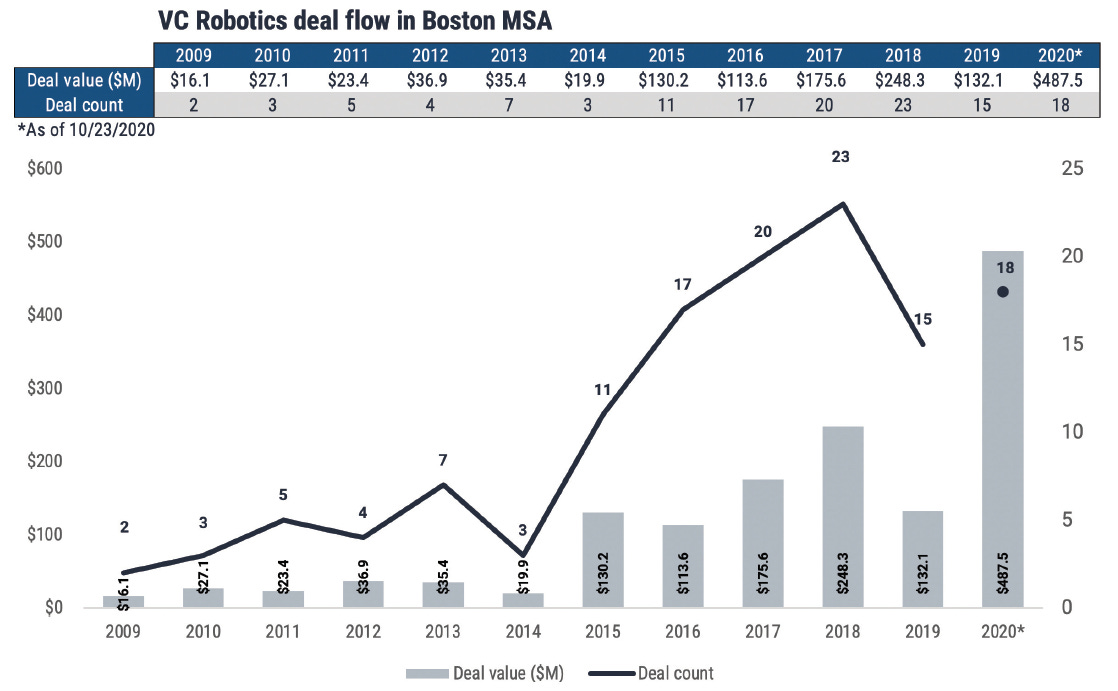

Fabric Media and the NEVCA just released an excellent deep dive on the growth of the Microlocation Robotics industry in Boston

The report highlights some of the key tech and regulatory breakthroughs needed to allow robots and humans to safely collaborate and covers a cluster of Boston companies that are leading the pack to make it happen — like Veo Robotics, Realtime Robotics, and Humatics.

Microlocation robotics combines various sensors and software to allow robots and humans to operate within close proximity to each other in environments where we can’t have full autonomy and don’t want manual labor.

Part of why I started writing this newsletter was to highlight the many incredible companies growing within this ecosystem that frequently get ignored by the outside world (and to learn about them myself). The repeatable model of this writeup is a great way to bring attention to the thriving startup ecosystems hiding right in our back yard. Especially when even a subset of one of these verticals makes for a great analysis. I bet many of you reading this can think of some completely under-reported transformations happening right under the outside world’s noses in Boston.

Zach Servideo, Galen Moore, and Kyle Gibson are doing some fantastic work for the city’s storytelling (two case studies from this report have already been used by TechCrunch) and I’m excited to see how they could replicate this model with other budding verticals that are hiding in plain sight. PropTech? Crypto? Wearables? Let him know what you’d like to see covered!

Stuff I’m Reading:

One Way Ventures Closes a Second $58M Fund + Is Hiring an Analyst/Associate

SVB Just Made an Even Bigger Push Into Wealth Management — TechCrunch

Profile of Tim Berners-Lee’s Data Sovereignty Initiatives — NYT

How Uber Discovered 80% of its Ads were Useless — Indi Samarajiva

Money Laundering Via Author Impersonation on Amazon — Krebs On Security

Non-Obvious Lessons from 100 Angel Investments — Tod Sacerdoti

Boston Financing Deals:

Thrasio 📪

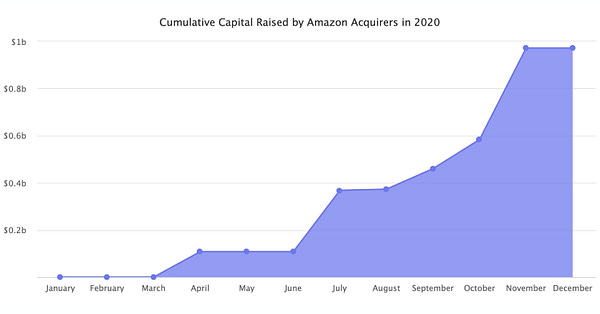

If you’re a regular reader, you’ve heard me ramble about the insane growth of the budding Amazon FBA acquirer industry a few times now. It never stops! Market-leader Thrasio just announced another $500M in debt to make even bigger deals.

“We’ve never bought a company with $180 million revenue, not because they don’t exist, but up until now we have shied away from that space,” Silberstein said. “Now we are in a position to do multiple deals with companies in the $50 million to $200 million revenue range.”

More:

New Interview with Thrasio Founder Carlos Cashman — Patrick OShaughnessy

Cumulus Digital Systems 👷

Cumulus Digital Systems, a three-year-old company building IoT solutions for industrial maintenance and construction, just raised $8M. It’s a software platform that connects workers, tools, and data to the cloud to help manage quality and productivity. The company, led by Matthew Kleiman, did a seed round back in 2018 led by Brick and Mortar Ventures, with participation from AVG and Shell Ventures.

Boston Metal 🛠️

Boston Metal, a company developing technology that produces alloys without C02 emissions, just raised $50M in part of a new $60M Series B round. They’re previously backed by Breakthrough Energy Ventures, Prelude Ventures, and The Engine.

Molten oxide electrolysis is a process in which electricity transforms metal from its raw oxide form into molten metal products. The MOE process was invented on the lab-scale at MIT, and Boston Metal has since scaled up the technology by a factor of over 1000. — ASM International

iBoss ☁️

NightDragon and Francisco Partners just poured $145M into the 17-year-old network security company iBoss — gearing them up for IPO. The company’s platform uses SASE architecture to defend companies from cyberattacks by securing all activity in the cloud, regardless of device or location.

Paperless Parts ⚙️

Four-year-old machine shop software company Paperless Parts just raised $7.1M from so far undisclosed investors. They offer a platform for manufacturing facilities to manage operations more efficiently — mainly for things like CRM, ordering, and invoicing.

PredictAP 🤖

PredictAP, a six-month-old pre-launch fintech company, just raised $2.8M. Their site says they’re using AI to automate the accounts payable and payment processing needs of real estate investment funds.