Boston Bias by the Numbers

One thing that I’ve been curious about lately is the “change of guard” in investment activity for Boston companies and VCs. I was lucky enough to dive deep into the topic while interning at SVB last summer and that research was actually a catalyst for starting this newsletter.

We saw all the data from various quarterly reports I covered last week, specifically that Massachusetts companies raised ~$4B across ~200 deals. I wanted to dive a bit deeper and look at the scope of deals that were done within the ecosystem versus being supported by outside capital. In other words, what’s the prevalence of Boston startups raising from Boston VCs?

Boston VC “Market Share” by Capital Investment

I compiled data on Pitchbook by searching all venture deals in Boston and then overlaying it with deals that were flagged as having at least one VC with its main headquarters in Massachusetts. I’m sure these figures aren’t perfect, but I like them as a general indicator of local investment activity. By deal count, this number has remained steady at around 50% in the last year.

I think by capital investment, the difference is clearer:

Why track this? Because I think it might be a better proxy for understanding how the ecosystem is growing from within. Given that the VC model involves high levels of engagement with portfolio companies, I think it could be argued that a local investor might have a greater operational impact, especially in the early stage. A few reasons why I think this:

VCs are “super-connectors.” Their job as both a steward of LP capital and as an advisor to startups requires them to have an unfair view of resources for their companies to utilize. This, of course, doesn’t mean that VCs are the core driver of startup success, even if some think they are. I don’t think there are many scenarios where an outside investor has a better view of an ecosystem than a local one.

Inside investments mean inside returns. If a West Coast investor holds a majority stake in a Boston startup that exits, that carry goes to West Coast investors and the LPs that backed them. If a Boston VC gets the greatest upside from a Boston exit, it may increase the probability of that VC raising another fund and therefore committing more capital to the same ecosystem. Luckily there are also early employees who, if paid fairly, got a great deal of upside and may want to become an angel with a bias toward their stomping grounds.

Similarly, there are many cases where an operator within a VC’s portfolio comes on board as an investment partner after a successful exit. These operators have a unique view of a given market and could give an unfair advantage to the startup as an advisor or board member. If a Boston founder exits and joins a Boston VC, perhaps there’s a higher likelihood that they seek to deploy more capital in the ecosystem that gave them a successful outcome.

It seems like there is strong potential for some virtuous cycles to take place by receiving capital from an investor within an ecosystem. There is some research that has been done on the topic over the last decade:

Douglas Cumming and Na Dai did a study on local bias in venture capital investments in 2009. They propose that reputable VCs and VCs with broader networks exhibited less local bias and that investment stage and specialization increased that bias. Their research also posits that VCs exhibit a stronger bias to local investments when they’re leading a round or acting as the sole investor. Lastly, they claim that the distance between investor and investment location does indeed have a material impact on investment outcome.

Two years later Robert Wuebker, Bill Schulze, and Roman Kraeussl also studied how proximity impacts investment outcomes. They claim that distant investments performed better than local investments in some situations. They also claim that having a local co-investor in a deal “yields surprisingly few benefits.”

Jason Rowley talked about it on TechCrunch as well back in 2017. He writes that “Local Loyalty” is waning, but the amount by which it is depends on the type of investor. Family offices and corporate VCs appear to be the most location-agnostic. When measured by the investment stage, he found that angels and early-stage VCs unsurprisingly exhibit more local bias than later-stage funds.

My only caveat with historical research like this is that, if these researchers started a VC firm with these findings as a thesis, we still might not be able to understand any measurable difference in outcomes, given that these findings were published <10 years ago and VCs often operate on a 10+ year investment horizon.

Anyways, I thought it would be of interest to readers and would love to hear your take on the topic.

Some Stuff I’m Reading:

41% of Startups Have Less Than 3 Months of Cash — Startup Genome

An Honest Take on “We’re Open for Business” — Jeremy Liew (Lightspeed)

Tech Deals Last Week:

BioBot Analytics 💩

I didn’t expect one of the largest venture rounds in Boston this week to have “Everybody pees and poops, every day” on their landing page, but they aren’t wrong. By some estimates, the human population generates about 19.5 billion pounds of poop a day. It’s about time we start pulling data from the waste in our bodies and not just the waste we generate on Twitter.

BioBot Analytics is an MIT-founded company that pulls data from wastewater sewage to generate health insights about populations. They just raised a $6.7M Seed Round led by The Engine and AmFam Institute Impact Fund. Previous backers include Data Collective, Hyperplane VC, Homebrew, YCombinator, Rough Draft Ventures, and around 13 others. Not only is human waste rich with data and “passively generated,” but it also doesn’t need to be tied directly to individuals, instead it enables an anonymized macro-view of a population’s health. BioBot is currently using its unique poo-analyzing abilities to map out COVID—19 prevalence across the country.

Compt 💰

Per Business Insider and a company press release, Cambridge-based Compt has raised a $1.5M Seed Round led by Harlem Capital, with participation from Slack and Impellent Ventures. Compt helps employees get uniquely rewarded for what they do through tailored benefits and perks.

They’ve built a platform that helps employees hand-pick perks and benefits that are relevant to their needs from any possible vendor. Once an employer sets guidelines, anyone in the company can expense appropriate activities through the product. I’d personally love to get a monthly book stipend, fully-paid Udemy course, or hot yoga membership as opposed to some of the “blanket” benefits that most companies offer. According to Linkedin, they now have 19 employees with Amy Spurling as CEO.

XRHealth 🥽

XRHealth, a medical virtual reality company, just raised $7M from Bridges Israel, Flint Capital, and 20/20 HealthCare Partners. They provide a variety of physical and psychological treatment telehealth kits that are delivered through VR. They utilize existing VR hardware (HTC Vive Focus, Oculus Quest, or Oculus Go), renting it out to users, and have developed the software and platform behind it. After a 25 module training program, existing clinicians can join the platform for extra income by treating patients remotely in VR.

TechCrunch covered the company quite well this week. The only thing I would add is that digital experiences as a form of therapy are truly being put to the test during this pandemic. For example, Animal Crossing is becoming the standard coronavirus therapy for many.

Randori 🛡️

Cybersecurity company Randori just raised a $20M Series A from Harmony Partners, Accomplice, .406 Ventures, and Legion Capital. Founded in 2018, the company’s cybersecurity platform is divided into Randori Attack and Randori Recon products. Randori Recon scrapes a company’s digital footprint to understand the total attack surface across all connected assets while Randori Attack provides an automated red team that continuously tests a company’s current defenses for those assets. The idea of hiring “white hats” to test your security infrastructure is by no means novel, but the Randori team claims they have a unique perspective by thinking like an attacker. Randori has now raised $30M in total. More from BostInno here.

CrowdPlay 🏈

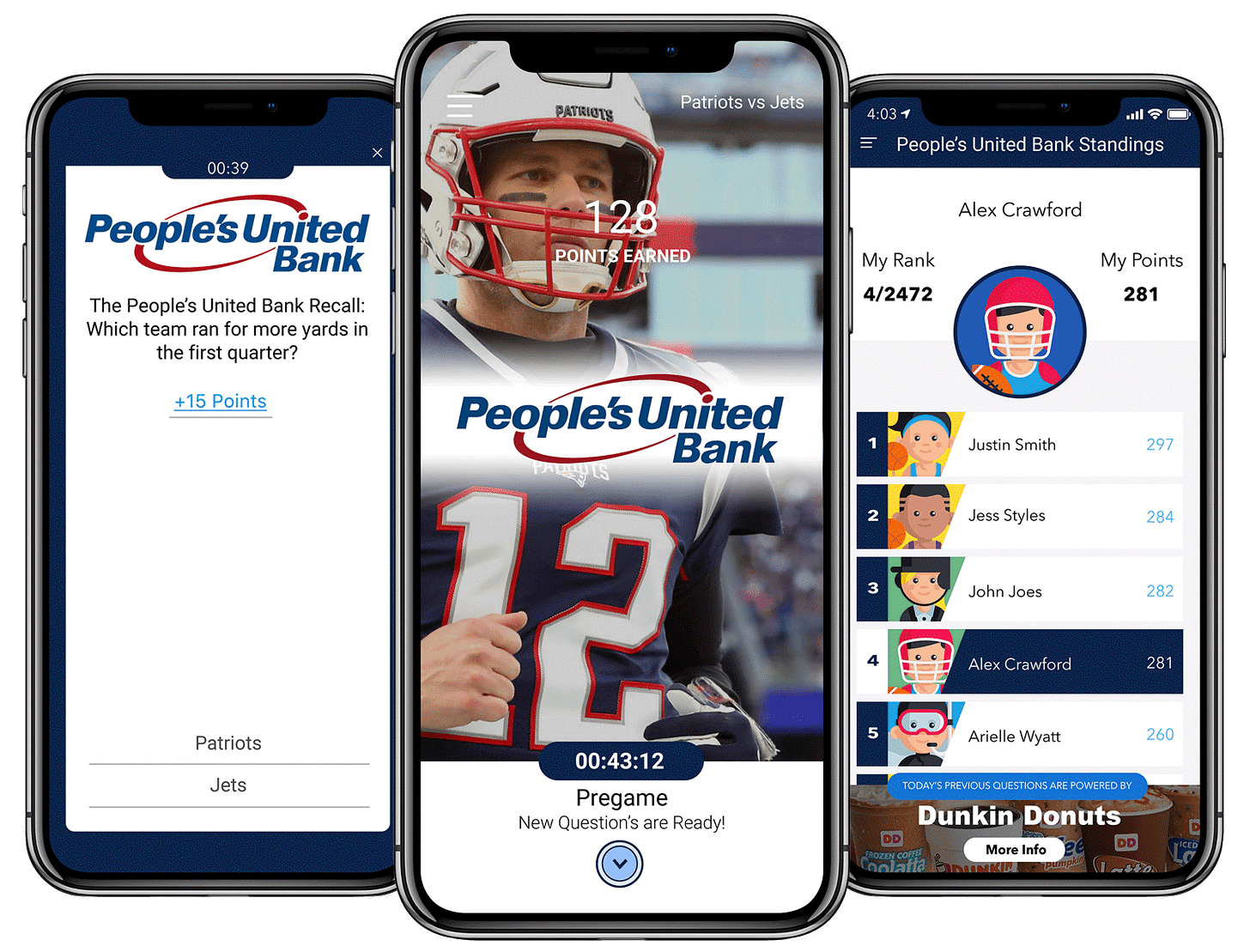

Fan engagement platform CrowdPlay has raised $1.13M in angel funding from Jennus Innovation, which provides investment and advisory services to companies in the greater Boston area. CrowdPlay is a mobile application aimed at augmenting the live sports experience. It hopes to keep fans more engaged during downtime and provide unique advertising opportunities to venues. The app helps venues drive sales to stadium vendors using in-app games that are relevant to the sports event happening in real-time. Climbing the leaderboard in these games can win users credits that can be redeemed for things like concessions, memorabilia, or other special perks.

Goodpath 🏥

As reported by BostInno, Cambridge-based telehealth startup Goodpath has emerged from stealth with $4M in seed funding led by Global Founders Capital, with participation from Indicator Ventures, Switch Ventures, and Blindspot Ventures. Goodpath started as an e-commerce marketplace for wellness products but pivoted to telehealth offerings in the wake of the pandemic. Users complete a short assessment concerning their chronic care needs and Goodpath matches them with the right kind of physician for a monthly fee.

Volta Networks ☁️

Networking infrastructure company Volta Networks has raised $11M from Project 11 Ventures, Hyperplane VC, PBJ Capital, and others. The five-year-old firm is a cloud-native virtual routing platform that makes networks easier to manage. They’ve created the first cloud-based control plane. In English, it means they’ve taken a core (and costly) part of a company’s network routing infrastructure and made it virtual — which makes routing resources far more scalable, easy to manage, and cost-effective.

ForeLight 🌿

Per a Form D, Cambridge-based AgTech company ForeLight has raised $2.7M. The company is going up against the producers of synthetic food and cosmetic ingredients used heavily in all sorts of consumer products. The problem is that all-natural ingredients usually means non-scalable production. Led by Timothy Fitzgerald, ForeLight is developing an indoor photosynthetic production technique that would make natural ingredient production more viable for food and cosmetic companies.

Overjet 🦷

AI-driven dental care analytics company Overjet has raised $7.8M from investors including E14 Fund, Liquid 2 Ventures, and Neoteny. The two-year-old company’s platform focuses on analyzing the performance of dental practice performance to identify growth areas and accurately reviewing claims. It’s led by a group of Harvard and MIT scientists with Wardah Inam as CEO.

Lumii 🕶️

Lumii, an interesting company in the materials space, raised $2.25M this week from so far undisclosed investors. They are developing the Lumii Light Field Engine, which allows any printing press to create holographic images without special ink. This could be used for a variety of consumer products, but also for security measures on official documents or ID cards. Some examples:

Inari🌾

BostInno surfaced K2 HealthVentures’ $45M debt financing investment in Inari Agriculture, the world’s first seed foundry. The four-year-old company helps farms develop personalized and genetically diverse seeds. Previous backers include Flagship Pioneering and Acre Venture Ventures.

Thanks for reading!

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.