Some “Personal News”…

I finish college this week! Not the ending I thought it would be, but I have plenty to be thankful for. I got to be a college student in New England for two Pats Superbowl wins, a Sox World Series win, two presidential primaries, and a global pandemic. No amount of overpriced tuition can buy those things.

I’m currently phasing out my work with the Rines Fund, 10x Venture Partners, and the Millworks Fund and will be joining Silicon Valley Bank as an Associate this summer. I’m excited to continue writing about startups and tech deals post-grad, and I’m working on a few side projects that I’ll talk more about soon.

ICYMI: Breakout

Last week, Boston’s Pillar VC and Petri announced their newest joint venture, Breakout. It’s a free six-week virtual program for future founders who are considering building a new startup. It’s a two-hour weekly commitment in which participants work in peer groups and listen to guest speakers from the executive leadership at companies like Rapid7, Constant Contact, Pepperlane, JobGet, and more. Open to founders anywhere in the world and from any background, it covers concepts like validating your startup idea, forming your company, and understanding the world of venture capital. There’s a general track and a bio track exclusively for life science startup ideas.

Stuff I’m Reading:

VC Financing Deals:

Folx Health 💊

Stealth-mode digital health startup Folx Health just raised $4.35M, likely from Define Ventures. They’re building a prescription and medical service marketplace tailored towards the queer community. “Folx” is a gender-neutral noun for addressing a group of people, as opposed to using “folks.” They’re starting with four basic areas of service: PrEP, STI Testing, Hormones and Fertility Testing.

The Form D filing for the raise lists Lynne Chou O’Keefe as a Director, who’s a Founder and Managing Partner at SF-based Define Ventures, an $87M early-stage digital health fund. The firm already backed men’s wellness marketplace Hims, but their portfolio page also lists three stealth companies. The filing also lists Agneta Breitenstein as a Director, who previously co-founded Optum Ventures, and served on the board of Buoy Health, LetsGetChecked, Vim, and WellSky.

Linkedin also lists ex-Aetna employee Courtney Peterson as a Controller and Perry Markell as Director of Consumer Operations at Folx.

According to the website, the service is launching in fall/winter of 2021.

Jellyfish 🐚

I can’t believe there’s no jellyfish emoji…

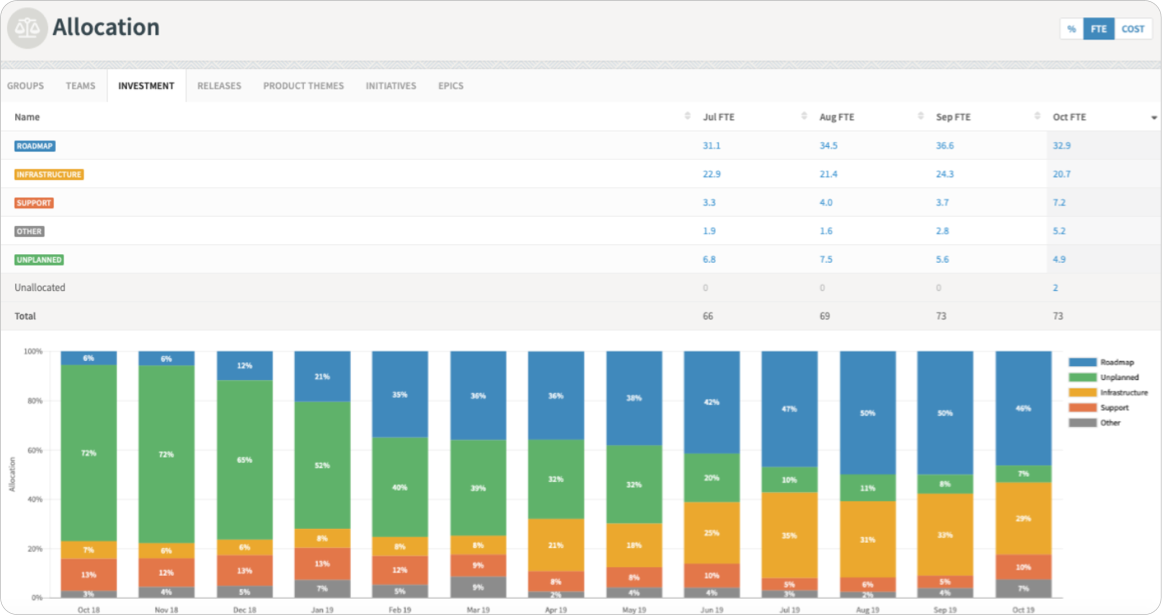

Jellyfish has raised a $12M Series A led by Accel and Wing VC. Other participating investors included Pillar VC, First Star Ventures, and Half Court Ventures. The Boston-based software company helps drive performance among engineering teams in enterprises, including current customers like Buildium, Toast, and Salsify. Jellyfish leverages data being generated by engineering platforms like Jira, ProductPlan, and GitHub to help company leadership understand engineering operations in a holistic way. This way, leadership can ensure that engineering work is closely aligning with long-term business objectives instead of generating unnecessary technical debt. According to Linkedin, they now have 28 employees, led by CEO Andrew Lau. Here’s a good blog post summarizing the problem Jellyfish is tackling and the road ahead.

Digital Alloys ⚙️

Three-year-old additive manufacturing company Digital Alloys is raising $1.2M. Back in 2018, they raised a $13M Series B from G20 Ventures, Khosla Ventures, Boeing HorizonX, and Lincoln Electric. Their Joule Printing process delivers low cost, high-speed production of hard metals. Most additive manufacturing machines use metal powders and heat to print metallic objects. Digital Alloys uses a wire-based melting process to simplify production. Here’s a spicy GIF of it in action:

![[video-to-gif output image] [video-to-gif output image]](https://substackcdn.com/image/fetch/w_1456,c_limit,f_auto,q_auto:good,fl_lossy/https%3A%2F%2Fbucketeer-e05bbc84-baa3-437e-9518-adb32be77984.s3.amazonaws.com%2Fpublic%2Fimages%2F49b942f7-e83e-4ac6-a100-b91c6a680d46_600x336.gif)

Formetrix 🦾

Mansfield-based Formetrix Metals just raised ~$500K from so far undisclosed investors. Previous backers include the Cycad Group out of California and a family office called SPDG out of Belgium. As I mentioned in the Digital Alloys deal above, most additive manufacturers rely on metal powders for printing hard metal specialty parts. Formetrix has a proprietary alloy that they claim provides an “unparalleled combination of hardness, ductility, toughness, and 3D printability.” I’d have to get an additive manufacturing specialist in here to know if Digital Alloys or Formetrix is doing it right. Formetrix has now raised ~$5M and Digital Alloys has raised ~$19M.

AllHere Education 🏫

According to Crunchbase, Boston-based AllHere Education just raised a $3.5M seed round led by Rethink Capital Partners’ education investing arm, Rethink Education. The company focuses on reducing absenteeism in school districts using a SaaS solution. Led by CEO Joanna Smith, AllHere’s technology empowers districts to use evidence-based strategies for intervention management in frequent absentees. According to their website, their service has already resulted in an 83% attendance improvement across 130,000 students. It’s being used in public school districts in Boston, Holyoke, Springfield, and Lawrence, among others.

CIBO Technologies 🌾

Back in January, I wrote about CIBO Technologies raising $7M out of a $15M equity offering. A new Form D filing shows they’ve raised $10M. The Cambridge-based AgTech company uses various data feeds to generate insights about the value, productivity, stability, and sustainability of farmland. Using the website or mobile app, users can map out acres of farmland and arrive at data-backed valuations for land parcels. The tech could be used for scaling agricultural operations using a data-driven approach, or maybe even as a tool for derivatives traders. Previous backers include Flagship Pioneering, Red Cedar Ventures, and Generation Investment Management. The service is free, but you can upgrade to CIBO Plus for more advanced analytics.

LifePod 👴

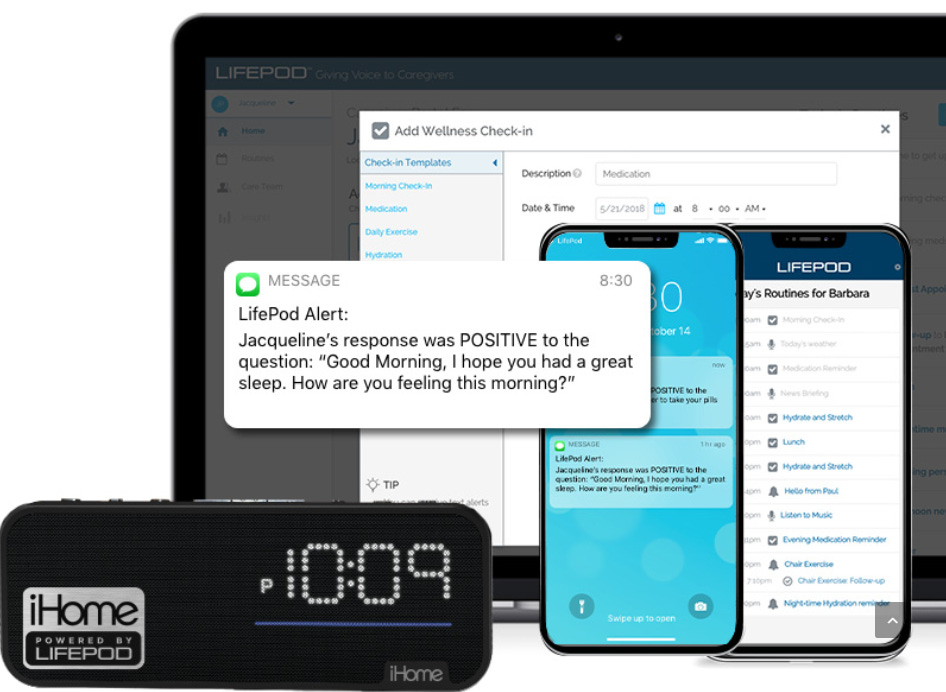

Boston-based LifePod, a voice-based caregiver, has raised $5M in seed funding from Winter Street Ventures (a venture arm of Commonwealth Care Alliance). Previous backers include angel investor and Walnut Ventures member Ben Littauer. The company leverages existing smart speakers to help caregivers communicate with patients. The software connected to the speaker can initiate pre-recorded check-in routines with patients and select people can receive SMS notifications of any interactions that a person has with the speaker.

According to Pitchbook:

“The funds will be used to distribute approximately 10,000 of LifePod proactive voice units to its members across Massachusetts as part of a broader virtual care program the organization is deploying during the COVID-19 crisis.”

PaymentWorks 💸

PaymentWorks, a six-year-old fraud detection platform for payments, is raising $4M. They’re previously backed by NY-based VC firm Uncommon Denominator. PaymentWorks has developed a platform for safely facilitating payments between corporate payers and payees. They automate the identification and verification of payment credentials for businesses to reduce costs, ensure compliance, and eliminate fraud. Their total raised is now ~$24M.

Digital Guardian 💽

Digital Guardian, a Waltham-based Data Loss Prevention (DLP) company, is raising $35M in late-stage development capital from PE firm LLR Partners, according to a press release. The 17-year-old firm has now raised ~$370M, with previous Boston investors including MassMutual Ventures, GE, Fairhaven Capital, and Loring Wolcott & Coolidge. They offer a variety of cloud-based risk management solutions as a SaaS model.

Thanks for reading!

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.