Hey all,

A shorter post this week because it’s too beautiful out to be indoors writing! Thanks for all the feedback and for sharing last week’s piece on the impact of local investors. I had fun learning about it and it sparked some future post topics I’m excited to dive deeper into:

What actually differentiates local VCs? How do they stay competitive?

How do early-stage investors find (and win) deals?

ICYMI: Demo Day 📺

Techstars Boston had their first Virtual Demo Day and I thought it went great. They even had a guest appearance from ICE-T with the perfect amount of cringe. Here’s the collection of all of the companies that presented and here’s a one-sentence summary of what they do:

Deep Tech 🥼

Phoenix Tailings — Extracting value from mining waste.

Cortex — De-risk investments in visual communications.

Monitaur — Understand why AI is making the decisions it does.

Consumer 🛒

Cobu — Software for residential community building.

S/O/S — Rethinking access to women’s health products.

InsurTech 🛡️

Worthright — Sell or refinance your life insurance.

Wunderite — Software to make insurance agents’ lives easier.

Healthcare 🚑

Kumuda — Software-enabled drug discovery.

Precavida — Healthcare marketplace for Brazilians.

Statera — Fixing the broken physician compensation system.

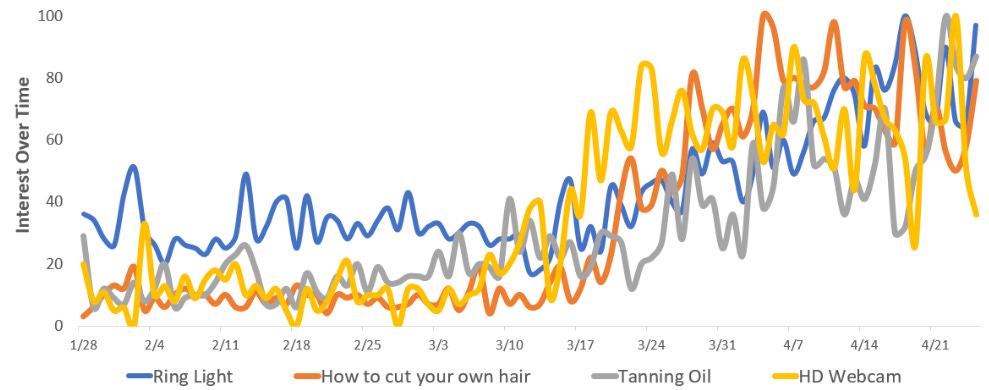

Aesthetic Improvements in the Age of Zoom 💄

Everyone is starting to feel ugly from lack of sunlight and happiness. Interesting to see the breakout in aesthetic-related searches pulled from Google trends. What’s most interesting to me is that it feels like “Beauty Youtube” is having its breakout moment. Beauty-related DIY content has exploded over the last decade, but it still somehow feels like a closed community. I do think there was some DTC fatigue before the pandemic, but I’m pretty bullish on the continued growth of this space.

What I’m reading:

VC Financing Deals:

enVerid 💨

BostInno and FinSMEs both covered Breakthrough Energy Venture’s latest $20M Series B investment into enVerid Systems. Other participating investors included Ajax Strategies, Building Ventures, and OurCrowd. I published a bit about them back in March when an SEC filing revealed the $20M raise. The ten-year-old HVAC Load Reduction (HLR) company minimizes the amount of air and energy needed to maintain indoor air quality for buildings.

enVerid has developed energy-efficient air ventilators that can remove all known molecular contaminants from indoor air. Current HVAC systems must pull air from the outdoors constantly to maintain clean air at a comfortable temperature. By effectively recycling indoor air, enVerid can help customers save up to 30% on annual energy costs.

From FinSMEs: “The company intends to use the funds to scale support and operations, increase its investment in product development and expand its market coverage with additional distribution partners.”

Paytronix 🥡

Newton-based Paytronix just raised $10M from PE group Great Hill Partners, financed by Silicon Valley Bank. The 19-year-old company creates software to manage the entire customer experience for restaurants. They offer customer loyalty programs, CRM systems, payment systems, and online ordering services to increase customer order volume.

According to CS News, the funding is being used to meet the growing demand for online ordering in the wake of massive restaurant closures from COVID—19. They’re going up against the payment infrastructure being built by companies like Toast, Instacart, and UberEats.

Sigma Phase 🍦

Stealth-mode (?) ice cream machine company Sigma Phase is raising $2.5M in equity, per a Form D. Here’s what I could find about the Lexington-based company:

It’s led by Matthew Fonte, ex-Director of Material Science & Technology Development at Arthrex. It’s VP of Operations is Robert Devaney, also an ex-Arthrex employee. It’s VP of Engineering is John Heymans, ex-Director of Advanced Engineering & Technology at Standex Engineering in Billerica.

The term “Sigma Phase” usually refers to an intermetallic compound made of chromium and iron. The phase occurs when metals cool through the temperature range of 550 — 1050 °C and begin to lose ductility, toughness, stability, and corrosion resistance. However, this doesn’t appear to be a materials science company.

According to several USPTO applications, Sigma Phase and Matthew Fonte have patented a system for “Providing a single serving of a frozen confection” using pods and “Rapidly cooling food and drinks.” Further, Sigma Phase became a member of the International Dairy Foods Association in August of last year. They also have a trademark for “COLDSNAP” ice cream making machines.

WindESCo 🔋

Back in February, I wrote about WindESCo raising ~$5M from undisclosed investors. It looks like that round has developed into a $10M Series B led by WAVE Equity Partners.

The company focuses on using IoT solutions to generate and leverage wind farm data. Their technology includes a rotor monitoring system, individual blade monitoring device, data transmission devices, and a software system to analyze it all. They leverage this captured data to improve the annual energy production (AEP) of wind turbines while increasing the lifespan of its individual components. Annual energy production is one of the key figures in estimating a wind farm’s IRR. They have received several grants from the Massachusetts Clean Energy Center as well.

SciAps ⚛️

SciAps, an eight-year-old company that builds tools for identifying compounds, is raising $4M in debt. The company develops handheld devices that help workers in agriculture, chemistry, mining, law enforcement, and more quickly identify the elemental concentration of any material. They use tech like Laser-Induced Breakdown Spectroscopy (LIBS) devices, X-Ray Fluorescence Spectroscopy (XRF) devices, and good old fashioned Raman Analyzers. Previous investors include CEI Ventures, Rand Capital, Enhanced Capital Partners, Eastward Capital Partners, and others.

Thanks for reading!

That’s all from me until next week — If you’d like to connect with me, you can find me on Linkedin and Twitter or check out my website at nickstu.art.

Missing something? Spot an inaccuracy?

Email me and tell me about it! I’ll be sure to share it in my next update.