Tiny Sellers, Meet Tiny Buyers

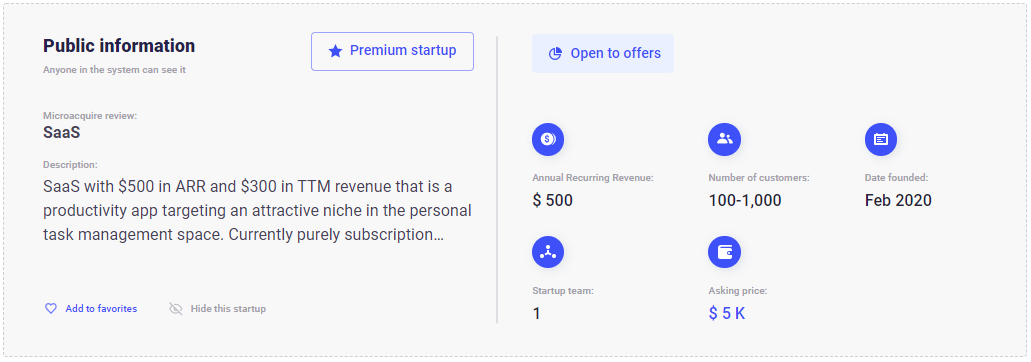

One West Coast fundraise that caught my eye last week was one-year-old Microacquire announcing a $2.8M seed round from Jeremy Levine of Bessemer, Naval Ravikant, Remote First Capital, and Andrew Wikinson’s Tiny Capital. It’s a startup acquisition marketplace that wants to “normalize small, but life changing, acquisitions.” The kind of acquisitions that a VC would scoff at, but an indie hacker would be set for life with. Entpreneurs can sell businesses for as little as a few thousand to several million. Microacquire itself has even acquired a company, buying SMB acquisition marketplace Exitround back in April. Aside from the marketplace aspect, they also help by founders providing escrow services, valuation insights, and deal brokering.

As I’ve discussed in several posts on FBA acquisitions, I’m fascinated by platforms and aggregators creating new exit opportunities for the non-venture-backed class of entrepreneurs. Running a successful eCommerce marketplace can now generate seven-figure exits for many people. Similarly, these micro acquiring websites are making a Slack bots, chrome extensions, or other software widgets generate big paydays that they couldn’t before.

Are Any of Them Actually Valuable?

I think a concern, especially when you get to very small dollar amounts, is what you’re really able to purchase for such a small value. There’s a large chance you’re buying a piece of garbage. But, one man’s trash is another man’s treasure. There could be some valid reasons for a developer to sell a decent side project for a few thousand. Maybe returns from organic growth are declining, they lack the time to make additional personal investment, they didn’t know how to monetize, or they want to sell it off to fund a new and more exciting project.

What could really make the difference is the buyers domain expertise. Perhaps you know how to rebuild their tech stack more efficently and save on overhead. Or maybe you know the market they’re selling to better than they did. Or they just never learned how to monetize and you have a knack for it.

Or, if anything, some of the posts are a great way to validate what a realistic goal for a new side project should be. You get real data on download numbers and gross profit for, say, the App Store’s leading Tic Tac Toe app or the fastest growing PDF Scanner app on the Google Store. In fact, it appears that Flippa’s valuation tool is a chat bot where entrepreneurs plug in their data to get a quick valuation figure. Even if they don’t end up selling, both parties are enriched with new information. This is the exact strategy that Keith Rabois is using at OpenStore — the newest eCommerce aggregator focused on Shopify stores.

I put together a list of what seem to be the main contenders:

More: Check out this post from Roman Beylin, founder for DueDilio, for an all-encompassing collection of the top micro acquirers, aggregators, and communities. DueDilio connects business buyers and investors with vetted on-demand due diligence experts to make these kind of deals go smoother.

More Reading:

What the creator of a $60k/yr Bingo Card Creator app learned from selling his business.

Eyal Toledano is running “Micro Angel,” where he buys a group of tiny SaaS products off of these marketplaces with the goal of improving them, rolling them up, then exiting. He’s publishing his journey on Substack.

If you’ve ever used, or thought about using, one of these sites I’d love to chat.

Stuff I’m Reading:

How SVB became a pre-IPO play—then a top-performing stock itself

AngelList Venture introduces “Deal Partners” for shared carry

TikTok launches video resume tool, pilots with 30+ companies

Boston Tech Financing Announcements:

Linus Health ⏲️

Digital health company Linus Health just raised $55M led by Morningside Ventures. Their platform helps screen individuals for Alzheimer’s Disease with some FDA-approved cognitive assessments. Much like Alkili Interactive having an FDA approved app for ADHD, Linus has an FDA approved app that has patients draw pictures of clocks in three minutes to understand their cognitive ability.

Silk 💾

Needham-based “database superchager” Silk just raised $55M in Series B funding led by S Capital. Additional investors included Sequoia, Pitango, Globespan, Ibex, Vintage, Clal Insurance, and Bank HaPoalim. Their product sits between your cloud databases and apps to provide increased efficiency and resiliency.

Newstore 🛍️

Omnichannel store solution company Newstore just raised $45M+ in Series B-1 funding. Their platform enables mobile-first order mangement, POS, and inventory management for DTC companies and retail brands. Scott Galloway is listed as an advisor, so best to try and short them if possible.

Assured Allies 🧓🏼

Longevity assurance platform Assured Allies just announced an $18.3MM Series A led by Core Innovation Capital and New Era Capital, with support from Wilton Re, LionBird Ventures and Harel Insurance. They want to use data science to accurately predict aging-related medical interventions to save insurers and families money.

Pickle Robot 🥒🤖

Pickle Robot just received a strategic investment of $15.4M led by packaging solutions provider Ranpak (filing). Back in April, I wrote that the company picked up a $5.8M in seed round led by Hyperplane VC. They are trying to improve efficiency in warehouse logistics by building a robot that can move around parcels, even when they’re disorganized, in a collaborative environment with humans.

Verve 🦾

Following the announcement of a high-profile partnership with Ahold Delhaize, exosuit company Verve Motion has raised $15M (per a new filing). I first covered them in April’20 when a filing showed they raised $5.3M from investors including Founder Collective. This latest filing also includes Founder Collective, with the addition of Dayna Grayson from Construct Capital. The Wyss Institute spinout offers a soft robotic exosuit to improve strength, mobility, and endurance in factory environments.

Molten 🌋

A new filing shows that Molten has raised $6.8M. Led by Arjun Mendhi, Molten is simplifying digital media operations with a cloud solution that includes rights management, content management, and delivery management. According to Crunchbase, previous investors include Jack Dorsey, Todd Ruppert (Greenspring Associates), Kevin Yorn (Plus Capital), and Valor Capital Group.

Ennoventure 🔍

Ennoventure, which is based out of Cambridge and India, just raised a $5M Series A led by Fenice Investment Group. Led by Padmakumar Nair, the company wants to insert invisible crypto signatures into brands to ensure authenticity.

Just the other week, I covered Proof Authentication’s Series A. I’m also curious to know how Dust Identity has been doing since raising a $10M Series A two years ago this week.

Lucidity Lights 💡

On the heels of acquiring Evolution Lighting, a new filing shows that Lucidity Lighting has raised $4.9M. They’re the creator of the DTC light brand Brilli, which sells lights that are engineered and sold as wellness-enhancing.

InsightSquared 📊

Another new filing shows that 11-year-old InsightSquared has raised $4M. The sales intelligence platform has now raised ~$50M from investors including Tola Capital, Threshold, Atlas Venture, and Accomplice — with the last formal funding round being a 2018 $23M Series D.

Compt 💸

A recent filing shows that employee perk stipend management software provider Compt has raised $1M. Back in April of 2020, the company raised $1.5M led by Harlem Capital, with Slack and Impellent Ventures also participating. They help employees easily shop from vendors of their choice with work stipends in a way that’s IRS compliant.

OneScreen.ai 📺

OneScreen.ai, which specialized in Out-of-Home advertising, just raised a $1M pre-seed from led by TechFarms Capital, with additional participation from investors including Wayfund, Mike Volpe, and Hubspot founders Dharmesh Shah and Brian Halligan.

Great write-up. I compiled a very comprehensive list of these marketplaces if someone really wants to dig deep: https://thebusinessinquirer.substack.com/p/deal-sourcing-guide-by-tbi