Why Tiger Global Breaks the Knight's Code of Honor

Plus Boston Tech Casually Raising $400M+ Last Week

Tiger Global doesn’t fight with honor, and they’re totally fine with that

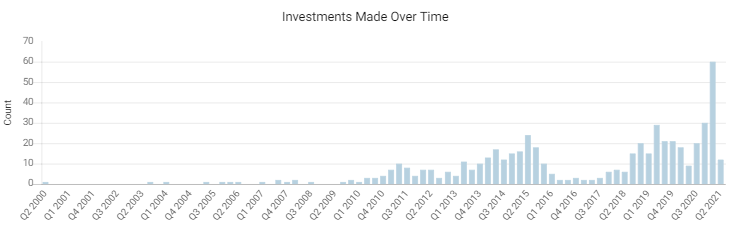

If you work within the tech or venture ecosystem, you’ve undoubtedly heard the name Tiger Global come up in the last few months. They’re the $65B AUM crossover fund that has been averaging four venture deals a week in 2021. Most recently, they participated in Clubhouse’s Series C valuing them at $4B.

Everett Randle just wrote a Very Good analysis on the firm called Playing Different Games that attempts to describe their investment strategy by comparing it to Bronn’s fighting techniques in Game of Thrones:

Everett argues that the majority of venture capital firms follow a set of outdated norms to win founders over. Like a chivalrous knight (traditional VCs) fighting a scrappy mercenary (Tiger/Altimeter/Coatue), it doesn’t matter if you follow the Knight’s Code of Honor (VC norms) when you’re dead (losing deals). He further explains that Tiger won’t eat every VCs lunch, but alongside well-established top-tier funds, they’re putting pressure on undifferentiated and traditional VCs that sit in the middle of the market.

I highly recommend reading the full post, but if you don’t have time, I took some notes that stood out to me the most:

TL;DR:

Tiger Global is breaking some VC norms in order to develop a rare non-brand driven competitive advantage in the venture ecosystem. They do so mainly by betting that growth stage founders want a VC that’s a lot faster, a lot less involved, and a lot less price sensitive than competitors.

First, how are they able to break these norms?

Part of it is credibility. The firm has posted a 26% net IRR on their private investments since inception in 2003. Their LP base is willing to trust them to make some unorthodox investing decisions. Why? Because over 50% of that LP base is their own employees, and the other half recognizes that they have a lot of skin in the game + a strong track record.

Another part is simply size. Being so large means the massive investments they’re doing are just a blip in their bank account. Even some of the largest traditional funds out there can’t consistently do $100M+ rounds every other week.

Second, what norms are they breaking?

Part of it is speed, or “Maximum Deployment Velocity”: Investment gains are a function of time and returns. Reducing the deployment pace of a fund inflates capital gains, even in the face of lower returns. Tiger is deploying capital at a rapid pace that’s usually unseen in venture.

If you raise a billion dollars and put it all into profitable investments right away, you will make more money than if you put it in a bank account and spend years thinking about which investments to put it into. — Matt Levine

In order to make a high velocity investment strategy work, you need a scalable venture product. For Tiger, “scalable” means doing extremely light due diligence, not taking board seats, and outsourcing some value-added services. They’re operating in a highly leveraged fashion, with about $3B in capital per one investment professional (they have ~100 employees and ~20 investment professionals).

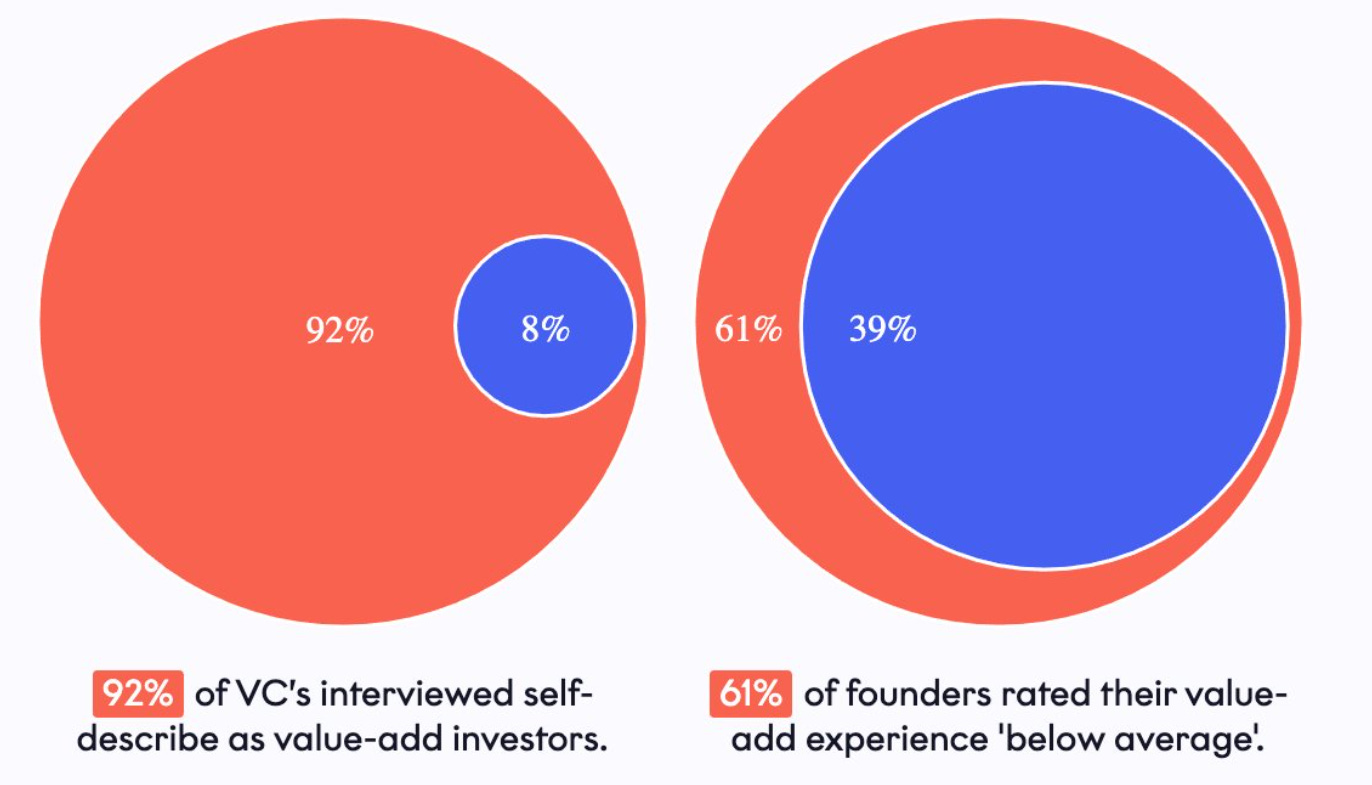

Tiger isn’t even pretending to be a Value Add™️ investor. Instead, they’re actually betting that founders would rather sell their equity for some low-touch, low-cost capital from a group of people that will let them expense Bain & Co. any time they’re struggling. Basically they’re saying, “We should be the least annoying that we possibly can while providing the best opportunity for the founder to build a massively successful business.” This runs parallel with their public markets investing thesis. They’re strictly concerned with owning the highest quality technology stocks for the longest period of time — price and active involvement is an afterthought.

Other VCs aren’t screwed, but maybe the J.C. Penney’s are:

Everett closes by discussing that brand as a moat is far from being dead. Many founders would prefer Sequoia or a16z over Tiger any day of the week, regardless of round pricing. That brand, network, and value-add is still very real. He compares this to the middle squeeze happening right now in retail. Basically the top tier funds (Sequoia/a16z/etc.) that compete in traditional ways are good because they’re the “luxury retailers” — the Apple’s, Sephora’s, and Tiffany’s — while these Bronn-esque firms (Tiger/Addition/Coatue) are low-cost vendors competing at massive scale — the Amazon/Walmart/Dollar General’s. Both have their place in the market, but does everything in between?

“The most exposed and vulnerable will be funds stuck in the “middle”. When choosing between capital providers, sometimes Founders will want the $12 Amazon Prime 1-day-shipping Carhartt T-Shirt, sometimes they’ll want the $1,500 Gucci Cardigan, but very rarely will they want the $22 J.C. Penney Hoodie. You really, really don’t want to be the VC version of J.C. Penney.”

Some of my thoughts:

I think the post does a great job covering competition around top branded funds and aggressive growth funds, but I think there are other important competitive dimensions. Where do rolling funds, solo capitalists, equity crowd funding rounds, etc. fit into the picture?

I think the post is fantastic, but maybe oversimplifies the value add that good traditional VCs are able to provide to portfolio companies — and probably even oversimplifies Tiger’s value add. I do get that, at the later stage, an exceptional team might really like the idea of a huge check with no strings attached, but this model just wouldn’t work in the earlier stages. A good example being the kind of legwork you get from a massive investment team like a16z’s where someone will fight to get Kevin Hart on your app’s beta. Plus they can’t just launch a seed fund like Index because it would change their whole business formula around a “scalable product.”

I also think all of the preemptive, massive funding rounds in the early stage these days will lead to a future where growth stage companies aren’t as mature as they look on paper. What I mean is that we frequently hear “today’s Seed is yesterday’s Series A” and I think that will trickle down the rest of the fundraising cycle to exit. I think it will lead to a lot of growth stage companies heavily relying on A+ growth stage guidance from good investors, which will favor the traditional model.

I think the entire formula behind this strategy will change drastically in a downturn. Right now, capital is so “cheap” that many businesses are forgoing even competitive non-dilutive financing for this kind of equity investment. Might that change when we see some heavy multiple compression?

Something about providing minimal due diligence, pre-maturely inflating valuations, and providing zero governance seems problematic to me. What could possibly go wrong here?

Brad Gerstner, the Founder & CEO of Altimeter Capital, spoke on the All In podcast on Friday about this aggressive crossover investment strategy & about SPACS. Worth a listen to get a deeper look at how crossover funds think about ownership.

Stuff I’m Reading:

Microsoft Buys MA-Based Nuance in their Second Largest Ever Acquisition

Coinbase CPO Sees a $646M Payday from Savvy Options Negotiations

Bitcoin and ETH Transactions Visualized as People Waiting at Bus Stops

COPA Takes Craig Wright to Court Over Bitcoin Copyright Claims — Coindesk

The Rise and Fall of a Massive Industry Based on Missed Calls — Rest of World

There’s a Single Publicly Traded Deli with $35K in Sales and a $100M Market Cap

Boston Tech Financing Deals:

SimpliSafe 🔒

Home security system software and hardware developer SimpliSafe just announced a $130M growth round led by existing investors. That’s more than double their entire total capital raised before the 2018 PE deal that valued them at $1B. They’re a notable tech success that got big with little or no money. Three years later, their trajectory continues to climb as they expect to pass $400M in ARR this year while hiring an additional ~100 engineers.

TetraScience 🔬

Insight Partners and Alkeon Capital just led an $80M Series B into TetraScience — a cloud-native open data platform for life science companies. They help researchers easily develop experimental datasets that can be selectively shared or utilized by organizations. Less siloed R&D data leads to better collaboration and ultimately more scientific insights. Their customers include 12 of the top 40 pharmaceutical companies, and they’ve seen ARR growth 10x since 2019.

HqO 🏘️

PropTech startup HqO just announced a new $60M Series C from investors including Accomplice, Insight Partners, JLL Spark, Navitas Capital, and others. They’re an end-to-end “tenant experience operating system” for commercial real estate firms. Their platform helps real estate firms manage all customer facing technology in one centralized location — manage vendors, understand building use, and create rich digital experiences for tenants. I last wrote about them when they raised a $34M Series B from Insight Partners at an $80M valuation.

Gradient AI 💻

Gradient AI, which provides AI/ML solutions for the insurance industry, just raised $19.7M in Series B funding according to a new filing. The three-year-old company focuses on providing automations and analytics to underwriting and claims operations. Total raised is now $30.7M, with previous investors including Forte Ventures and MassMutual Ventures.

Cohere Health🏥

Cohere Health just announced a $36M Series B led by Polaris Partners, with participation from Longitude Capital, Deerfield Management, Flare Capital Partners, and Define Ventures. Their platform aims to improve the prior authorization process of the patient care journey to reduce costs, administrative burden, and patient experience. Back in July’20, I wrote about them when they emerged from stealth mode with a $10M Series A.

1upHealth 👨⚕️

1upHealth just raised a $25M Series B led by F-Prime, with participation from Jackson Square Ventures, Eniac Ventures, and Social Leverage. The MassChallenge grad promotes easy interoperability among companies in the health industry by helping them utilize FHIR, a standard for application programming in health records. The company already works with Boston Children’s Hospital, the FDA, IBM, and several other institutions. It’s lead by ex-Google PM and NavHealth engineer Ricky Sahu.

Mori🌿

Mori, the developer of a silk-based protective skin that wraps around food to keep it fresh, has raised a $16M Series B. The round was led by Drawdown Fund, with participation from other investors including Acre Venture Partners, The Engine, Prelude Ventures, and others. I last covered them in July when they closed a $12M Series A led by Acre Venture Partners.

More:

Back in February, I wrote about a different Boston company that’s also developing edible membranes to preserve food called Incredible Foods.

Legacy 🍆

Male fertility startup Legacy just raised a $10M Series A led by FirstMark Capital, with other investors including Bain Capital Ventures, Section 32, YC, TQ Ventures, and Tribe Capital. They provide home fertility kits to help men test, store, and analyze sperm while getting expert advice from their fertility team.

Cambridge Semantics

Cambridge Semantics, a 14-year-old provider of data analytics and collaboration software for enterprises, just raised $8.8M in a $10M round according to a new filing. They offer an AI-powered knowledge graph platform for connecting disparate data across organizations to make it easier to use and more valuable.

Vesper 🔉

Acoustic sensor company Vesper just raised $8M in funding led by Applied Ventures, with participation from Accomplice, Amazon Alexa Fund, Bose Ventures, Sands Capital, and others. They develop piezoelectric MEMS (Micro-Electro-Mechanical-System) microphones and sensors. Their tech is set to dramatically improve the quality and durability of microphones used in the interfaces we interact with every day.

Pickle Robot 🥒🤖

MIT startup Pickle Robot just picked up a $5.8M in seed round led by Hyperplane VC (who also led their previous round), with participation from Third Kind VC, Box Group, Version One Ventures, and others. They are trying to improve efficiency in warehouse logistics by building a robot that can move around parcels, even when they’re disorganized, in a collaborative environment with humans.

Dover Microsystems 🛡️

Cybersecurity platform Dover Microsystems raised $3.3M out of a $5M round according to a new filing. The 11-year-old company focuses on providing hardware-level, physical protection to processors to protect software vulnerabilities.

Battery Resourcers 🔋

In my last post, I wrote about battery recycling company Nth Cycle raising $3.2M. This week, another lithium-ion battery recycling and manufacturing company called Battery Resourcers picked up $20M in Series B funding led by Orbia Ventures, with other investors including At One Ventures, TDK Ventures, TRUMPF Venture, Doral Energy-Tech Venture, and InMotion Ventures. They turn old batteries into nickel-manganese-cobalt cathodes that can be sold back to battery manufacturers.

Gamestake 🎮

Gamestake, a pre-launch company which allows people to invest in the upside of esports players and teams, has raised $135K in a $1.2M round per a new filing. Not much info on this one but it sounds like ISAs for esports players.

Thank you for the article! Very well-written. I would highly recommend to plan your blog in a productivity app: https://bordio.com/tools/project-managenent-tools/