Local Loyalty Revisited

Which Boston-Based Investors Back the Most Boston-Based Companies?

Local Loyalty in Boston

A while back, I wrote a post about Local Loyalty in Boston VC: How often are local investors backing local entrepreneurs? I’m revisiting because it’s been almost a year since I wrote that, and I’ve stolen a new Pitchbook login and you gotta take advantage of these moments.

I searched Boston-based tech1 companies that raised in the last year, then looked at the list of VCs backing them and divided them into MA-headquartered vs Non-MA headquartered. (Some non-HQ’d VCs definitely have a Boston presence, but aren’t HQ’d here). Obviously they’re only being tracked if the deals publicly announced, but probably a generally accurate ranking.

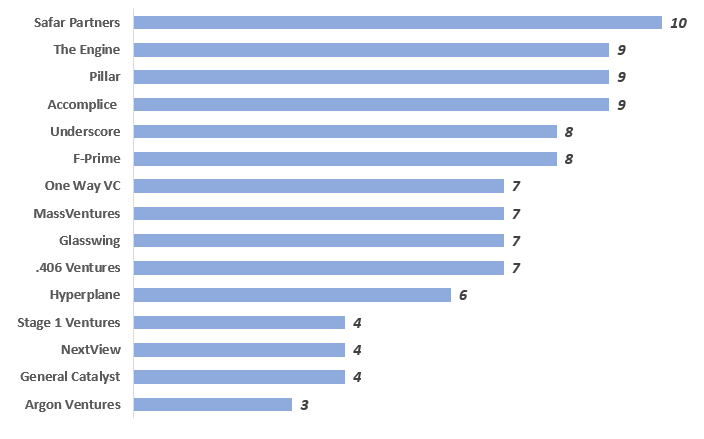

Top Boston HQ’d VCs Backing Boston Startups

Generally not too surprised by these. What would be cool is to further break it down by deal size and stage. What’s the largest and latest these investors can go while keeping things in the ecosystem?

Top Non-Boston HQ’d VCs Backing Boston Startups

Pretty cool to see a two-year-old New Hampshire-based investment group topping the list alongside Bessemer (although both do have a very strong Boston presence).

Links:

Why did I Leave Google or, Why did I Stay so Long? — Noam Bardin

Li Jin Launches Atelier Ventures to Invest in the “Passion Economy”

Boston Tech Deals:

Tiki 🍹

Mike Audi, the CTO of Blustream, founded a personal data monetization company called Tiki about a year ago alongside Uprise CTO Brian Gagnon. According to Pitchbook, they’re in the process of raising a first financing round with about 25% of it already closed. The company is spread across Boston, London, and Dublin according their to Linkedin.

In extremely 2021 fashion, I checked out their TikTok and Discord pages for more information. They came out of stealth back in October 2020 and are building an application to help users monetize their personal data on their own terms. They take user data, anonymize it and package it together, then sell it to big corporations. All revenue from the sale goes back into the user’s pocket and Tiki collects a service fee on the transaction. They’re banking on the fact that, with big enough users numbers, this data still could allow companies to uncover valuable user insights without being so invasive.

I’m not sure on the actual mechanics of how this would work, but it sounds interesting. As the power dynamics of ad control capabilities shift (with moves like Apple’s iOS 14.5 update), perhaps the timing is right for a “black box” product where users take control. They’ve already got a few thousand signups for their beta, and still have a few slots open which you can sign up for here.

Highland Electric 🚌

Highland Electric, a Hamilton-based company that provides full-service electric school bus fleets, just raised $253M from Vision Ridge Partners and Fontilalis Partners.

AdmitHub 🎓

Seven-year-old AdmitHub, which develops chatbots for student engagement, just raised a $16M Series B led by Rethink Education, with participation from Education Impact Fund and the Kresge Foundation. They use conversational AI to tackle the “Summer Melt” problem and also to help universities increase graduation rates. They’ll also be rebranding to “Mainstay.” I last wrote about them in February’20 when they raised a $7.5M Series A.

OutSystems 🖥️

Boston and Portugal-based OutSystems just raised $150M co-led by Abdiel Capital and Tiger Global at a valuation of $9.5B. The twenty-year-old company helps enterprises develop low-code applications for internal and external uses. It’s similar to Retool, which raised $50M from Sequoia last fall.

Locus Robotics 🤖

Warehouse robotics company Locus Robotics just raised $150M in Series E funding led by Tiger Global and Bond Capital, valuing the company at $1B and putting their total raised at ~$250M. They make robots that interact with humans (“co-bots”) in fulfillment warehouses to increase productivity and reduce the human workload. According to TechCrunch, the funding will be used to hire 75 people and to invest in additional R&D.

AirSlate ⚡

In late January, I wrote that low-code process automation company AirSlate had raised $40M from Morgan Stanley Expansion Capital, General Catalyst, and HighSage. Last week, the company went on to raise $50M in debt financing from Silicon Valley Bank.

Reprise 🤝

After raising $3.2M from Glasswing just three months ago, software demo creation platform Reprise just raised a $17M Series A led by Bain Capital Ventures. They’re developing a product that lets software sales teams use low-code tools to create demo environments for prospective customers to engage with.

Bluespec 💾

Bluespec, which offers tools to help companies utilize the RISC-V open standard ISA safely and efficiently, raised $2M recently. Founded in 2003, they offer “silicon-proven electronic design automation synthesis toolsets for the application specific integrated circuits and field programmable gate arrays.“

More: RISC-V: What it is, and what benefits it can provide to your organization

Incredible Foods 🍒

According to a Form D filing, I think Incredible Foods is raising $5M, with $1.75M already closed. The filing, under the name “Quantum Designs” shows Incredible Foods CTO Marty Kolewe as a director/executive, as well as several other team/board members of the company, and the Company’s HQ address.

The nine-year-old firm develops edible membranes that wrap around healthy foods to turn them into long-lasting healthy snack balls. Right now they’re prototyping wraps of hummus, berries, nut butter, yogurt, and more.

Super cool….and somewhat similar to Apeel, which has raised $390M to wrap produce in plant-based packaging to keep them fresh longer.

PaerPay 🍐

According to Crunchbase (not confirmed anywhere else), contactless payment platform PaerPay received a seed investment of undisclosed size from Chicago-based Chingona Ventures. After a successful pivot following the COVID-19 outbreak, the MassChallenge ‘18 alumnus switched from in-person dining payment tech to a contactless payment system for restaurants. They previously raised $335K in 2019 from Nobksa Point Capital.

Uplift 😴

According to Pitchbook, Uplift just raised $500K in angel funding. They’re the developer of a mobile app for “biohacking” your way out of jet lag using techniques similar to acupuncture. For $20/yr, the app will guide you through applying acupressure points to parts on the body that are intended to relieve your jet lag.

Relatively arbitrary label on what’s considered tech, but if you’re a regular reader, you probably have a pretty good idea.

The author's expertise and deep understanding of the topic shine through in every paragraph. It's evident that this piece is written by someone who knows the subject inside out. I feel like using a productivity and planning app for your blog would be helpful: https://bordio.com/tools/work-management-software/